Westjet 2006 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2006 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

152006 | WestJet Annual Report

MANAGEMENT’S DISCUSSION

AND ANALYSIS OF

FINANCIAL RESULTS

2006 AT A GLANCE

We would now like to tell you about

some important features of this airline.

The most important one is our people

(or WestJetters as we like to call them).

You can easily locate them – they’re

the ones with the smiles. The caring

treatment that WestJetters provided to

our guests in 2006 goes a long way to

explain the encouraging results that we

will be outlining in the pages ahead.

FORWARD-LOOKING INFORMATION Certain information set forth in this document, including management’s assessment of WestJet’s future plans and operations, contains forward-

looking statements. These forward looking statements typically contain the words “anticipate, ” “believe, ” “estimate, ” “intend, ” “expect, ” “may, ” “will, ” “should” or other similar terms. By their

nature, forward-looking statements are subject to numerous risks and uncertainties, some of which are beyond WestJet’s control, including the impact of general economic conditions,

changing domestic and international industry conditions, volatility of fuel prices, terrorism, currency fl uctuations, interest rates, competition from other industry participants (including

new entrants, and generally as to capacity fl uctuations and pricing environment), labour matters, government regulation, stock-market volatility and the ability to access suffi cient capital

from internal and external sources. Readers are cautioned that management’s expectations, estimates, projections and assumptions used in the preparation of such information, although

considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on forward-looking statements. WestJet’s actual results,

performance or achievements could differ materially from those expressed in, or implied by, these forward-looking statements. Additional information relating to WestJet, including Annual

Information Forms and fi nancial statements, is located on SEDAR at www.sedar.com. To supplement its consolidated fi nancial statements presented in accordance with Canadian generally

accepted accounting principles (GAAP), the Company uses various non-GAAP performance measures, including available seat mile (ASM), cost per available seat mile (CASM) defi ned

as operating expenses divided by available seat miles, revenue per available seat mile (RASM) defi ned as total revenue divided by available seat miles, revenue per revenue passenger

mile (“yield”) defi ned as total revenue divided by revenue passenger miles, operating revenues defi ned as the total of guest revenues, charter and other revenues and interest income,

operating margin defi ned as earnings from operations divided by total revenues, and load factor defi ned as revenue passenger miles divided by available seat miles. These measures are

provided to enhance the user’s overall understanding of the Company’s current fi nancial performance and are included to provide investors and management with an alternative method

for assessing the Company’s operating results in a manner that is focused on the performance of the Company’s ongoing operations and to provide a more consistent basis for comparison

between quarters. These measures are not in accordance with or an alternative for GAAP and may be different from measures used by other companies.

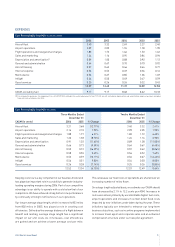

WestJet’s 2006 fi nancial overview tells a compelling story.

Favourable revenue growth, continued cost control and an

increasing demand for our product produced consistently strong

fi nancial results throughout the year. In 2006, we generated an

11.2% operating margin, 6.8 points higher than in 2005, and one

of the best operating margins in the North American airline

industry.

Our strong performance began in the fi rst quarter of 2006, with

profi ts that surpassed any other fi rst quarter in our history. The

momentum generated from the success of this period carried

through to the remaining quarters of the year where we also

realized record earnings. We completed the year with net

earnings of $114.7 million for the full year 2006.

LILLIANE HRNCIRIK

Payroll, Manager

CAROL ST. AMOUR

Payroll, Team Lead