Westjet 2006 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2006 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18 2006 | WestJet Annual Report

Our business is seasonal in nature with varying levels of activity

throughout the year. We experience increased domestic travel

in the summer months (second and third quarters) and more

demand for transborder and charter sun destinations over the

winter period (fourth and fi rst quarters). With the introduction

of our fi rst transborder destination in September 2004, we

have been able to somewhat alleviate the affects of seasonality

on our net earnings. In 2006, we focused on allocating our

network capacity to our domestic and transborder markets as

appropriate based on demand in the season.

In the quarter ended March 31, 2005, we reported a net loss of

$9.6 million as a result of the impact of lower fares throughout

the domestic airline system driven by intense competition

and extremely high fuel prices. This created a high-cost and

low-yield environment. Market rationalization was reinstated

at the end of March 2005 when Jetsgo ceased operations. This

materially changed our operating environment and we began

to witness signifi cant improvements in our yield.

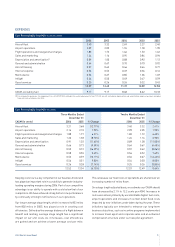

YEAR 2006 COMPARED TO YEAR 2005

REVENUE

Three Months Ended Twelve Months Ended

December 31 December 31

RASM (in cents) 2006 2005 % Change 2006 2005 % Change

Guest revenues 12.40 12.18 1.81% 12.44 11.31 9.99%

Charter and other 1.33 1.38 (3.62%) 1.61 1.68 (4.17%)

Interest income 0.13 0.08 62.50% 0.11 0.06 83.33%

13.86 13.64 1.61% 14.16 13.05 8.51%

Our 2006 fourth quarter operating revenues increased to $459.6

million, compared to $366.8 million in the same period 2005.

Full-year operating revenues increased to $1.8 billion during

2006, a 27.4% increase over that of 2005. The increase in guest

revenues was driven by a fourth quarter capacity increase of

23.3% to 3.3 billion ASMs and a full-year increase of 17.3%

to 12.5 billion ASMs. Our ability to fi ll these seats came from

marketing efforts, our ability to match our capacity to the

demands of our guests and our exceptional guest service that

continues to build brand loyalty and repeat business.

Our charter and other revenues per ASM decreased slightly

for both the full year and quarter ended December 31, 2006,

primarily due to an increase in our scheduled transborder

operations during these periods relative to our charter network.

We also generated non-transportation revenues from interest

income. Interest income during the year and fourth quarter 2006

increased as a result of our higher cash balance.

Ancillary revenues provide an opportunity to maximize our

profi ts through higher margin items while enhancing our overall

guest experience. We generate ancillary revenue primarily from

fees associated with guest itinerary changes, excess baggage

fees, buy-on-board food sales and headset sales. In 2006,

ancillary revenues grew by 67.6% over 2005 to $74.8 million.

A signifi cant revenue initiative we undertook during 2006 was

the launch of a wholly owned subsidiary of WestJet Airlines Ltd.,

WestJet Vacations Inc. offering guests packaged vacation

options that may include hotels, car rentals, attractions and

insurance. WestJet Vacations leverages our aircraft, schedule

and renowned guest experience while operating in the same

low-cost manner. Fully operational in September, WestJet

Vacations surpassed forecasted expectations for 2006.

During the year, we focused our strategy around seasonal

capacity adjustments. Shifting our capacity to higher-demand

markets, based on the seasonal demand for those routes, has

become an important part of our deployment strategy. Typically,

there is a natural decline in domestic travel during the winter

months, which fall within the fi rst and fourth quarters of our

fi scal year. During these slower times, we capitalize on the

ability of our sunny transborder destinations to attract leisure

travellers that want to escape the Canadian winter months. Our

ability to maximize fl eet effi ciency through diligent network

management has directly contributed to our noteworthy

operating margin performance throughout 2006.

Along with careful planning of our routes, fl eet optimization

was another focus in 2006, and contributed to the overall

productivity of our airline. During the year, we increased our

aircraft utilization by 5.3% to 11.9 operating block hours per

day compared to 11.3 operating block hours per day in 2005.

Increasing the utilization of our aircraft increases our revenue-

generating potential and allows us to gain cost effi ciencies.