Westjet 2006 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2006 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

212006 | WestJet Annual Report

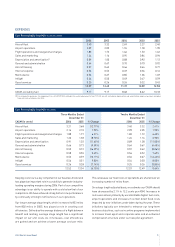

AIRPORT OPERATIONS

Our airport operations encompass costs associated with landing

and terminal fees, ground handling and onboard services, such

as buy-on-board food. Airport CASM increased 2.0% in 2006

to 2.09 cents from 2.05 cents. For the three months ended

December 31, 2006, the CASM for airport operations increased

by 1.9% over the same period in 2005.

In 2006, costs per departure increased 6.7% over 2005’s costs,

primarily driven by our increased transborder fl ights; utilization

of larger aircraft which drove higher fees; and an increased

number of fl ights fl ying into one of the busiest and most costly

airports in the world, Toronto’s Lester B. Pearson International

Airport.

Fee increases imposed by our airport and ground-handling

partners impacted us on average by approximately 6%. These

costs were further magnifi ed by our expanding international

charter and transborder operations, where the number of

departures grew by 7.9% in 2006 over 2005 and are charged

higher rates and fees compared with our domestic operations.

Our cost per departure for transborder and charter operations is

approximately 263% higher than that of our domestic fl ights.

Despite higher fees and costs per departure, our airport CASM

grew at a lesser rate primarily as a consequence of the increase

in our average stage length.

Airport operations make up one of our largest costs, representing

approximately 17% of our total operating expenditures. As we

continue to expand our transborder and international network,

these expenses will continue to be signifi cant to our operations.

In order for us to properly manage these costs, generally

controlled by airport authorities, we continually look for ways

we can improve productivity and reduce operational costs while

at the same time increasing the convenience to our guests.

We do this by seeking opportunities to automate our airport

operations, offering our guests convenient online check-in

services for destinations within Canada, as well as equipping

most of our airports with self-service kiosks.

The rise in unit costs for the quarter can be attributed to an

increase in our system-wide weighted average airport rates

and fees increasing by approximately 6%. Our transborder and

charter activity incur higher airport fees than our Canadian

operations, and the higher terminal and landing fees associated

with operating our larger 700-series and 800-series aircraft also

contributed to higher unit costs.

We are encouraged by the slowing pace of airport rates and fee

increases that we witnessed in 2006, as well as this continuing trend

in 2007 – based on the fee schedule released in January 2007.

FLIGHT OPERATIONS

Our fl ight operations are largely driven by the cost to compensate

our pilots, including salaries, training and stock option expense.

Our CASM for fl ight operations increased by 18.6% during the

fourth quarter and 15.4% for the full year 2006, over the same

periods in 2005. The increase in these costs is primarily due to a

new pilot agreement designed to improve our pilots’ compensation

structure and increase productivity. Approved in the beginning of

the year, this agreement allows our pilots to elect to receive a

certain amount of cash in lieu of a selected portion of their stock

options. In addition to the operational benefi ts we derive from this

new agreement, we also benefi t from the tax deductibility of the

elected cash outlay, whereas we do not realize any tax benefi ts

from stock-based compensation expense.

In the fi rst year of this new agreement, we incurred both a cash

expense, for the cash-elected portion under the new agreement,

as well as stock-based compensation expense related to the

options that were granted to all pilots in May of 2006 under

the terms of the old pilot agreement. As a result, in addition

to stock-based compensation expense, we incurred a cash

expense of $10.2 million and $3.8 million at year-end and in

the fourth quarter of 2006, respectively. Commencing in 2007,

we expect our stock-based compensation expense to decrease

as a result of the lower number of options issued due to pilots

electing to receive greater cash compensation in the fi rst year

of the new agreement. In 2006, we recognized $21.2 million in

stock-based compensation expense, an increase of 20.5% as

compared to $17.6 million in 2005.

NAVIGATIONAL CHARGES

Air navigational charges are predominantly driven by the size of

aircraft and distance fl own, and are administered on a per-fl ight

basis. On a per-departure basis, Nav Canada and FAA costs

rose 3.3% in 2006 over 2005, driven by higher fees associated

with operating larger Next-Generation 737 aircraft and our 3.9%

increase in average stage length. On a per-ASM basis, our year-

over-year navigational charges have declined by approximately

1%, primarily as a result of the growth in our network capacity

outpacing the increase in our number of fl ights.

SALES AND MARKETING

Sales and marketing encompasses a wide variety of expenses

related to advertising and promotions, travel agency commissions,

corporate incentive programs, credit card fees, global distribution

system costs, the AIR MILES® reward miles program costs,

and live satellite television licensing fees. CASM for sales and

marketing expenses increased 6.9%, from 1.16 cents in 2005

to 1.24 cents in 2006.