Westjet 2006 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2006 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28 2006 | WestJet Annual Report

CONTRACTUAL OBLIGATIONS, OFF-BALANCE-

SHEET ARRANGEMENTS AND COMMITMENTS

Our contractual obligations for each of the next fi ve years, which

do not include commitments for goods and services required in

the ordinary course of business, are indicated in the table below

(see “Contractual Obligations”).

We currently have 18 Next-Generation aircraft under operating

leases. We have entered into agreements with independent third

parties to lease 11 additional 737-700 aircraft over eight- and 10-

year terms in US dollars and two 737-800 aircraft over a 10-year

term, to be delivered throughout 2007 to 2009. These amounts

have been included at their Canadian-dollar equivalent in the

table above. Although the current obligations related to our

aircraft operating agreements agreements are not recognized on

our balance sheet, we include these commitments in assessing

our overall leverage. Our debt-to-equity ratio, including off-

balance-sheet debt of $442.3 million, was 2.3 to 1 at the end

of 2006 compared to 2.5 to 1 at the end of 2005, which is well

within our self-imposed range of acceptable debt-to-equity

ratios. Although we have increasing debt obligations from new

aircraft purchases, we

have successfully maintained an enviable

debt-to-equity ratio that refl ects our ability to effectively manage

our balance sheet.

CONTINGENCIES

On April 4, 2004, Air Canada commenced a lawsuit against

WestJet. Air Canada claimed damages in the amount of

$220 million in an amendment to its statement of claim.

On May 29, 2006, as a full settlement, we agreed to pay Air

Canada’s investigation and litigation costs incurred totalling

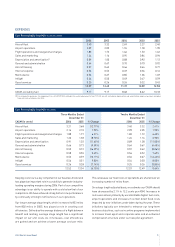

Contractual Obligations (THOUSANDS)

Total 2007 2008 2009 2010 2011 Thereafter

Long-term debt repayments $ 1,444,856 $ 153,720 $ 161,425 $ 145,593 $ 144,877 $ 157,466 $ 681,775

Capital lease obligations(1) 2,068 444 444 444 698 38 —

Operating leases(2) 1,237,791 102,375 118,338 137,906 141,627 139,453 598,092

Purchase obligations(3) 301,517 177,776 117,543 6,198 — — —

Total contractual obligations $ 2,986,232 $ 434,315 $ 397,750 $ 290,141 $ 287,202 $ 296,957 $ 1,279,867

(1) Includes weighted average imputed interest at 5.29% totalling $229,000.

(2) Included in operating leases are US-dollar operating leases primarily related to aircraft. The obligations of these operating leases in US dollars are: 2007 – $76,430,000; 2008 – $92,673,000;

2009 – $114,343,000; 2010 – $119,154,000; 2011 – $119,067,000; 2012 and thereafter – $500,035,000.

(3) Relates to purchases of aircraft, live satellite television systems and winglets.

$5.5 million, and accepted Air Canada’s request that WestJet

make a donation in the amount of $10 million in the name of

Air Canada and WestJet to children’s charities across Canada.

Air Canada withdrew its claims in light of this settlement. All

legal proceedings between the parties were terminated. These

amounts and other settlement costs totalling $100,000 have

been paid as at December 31, 2006, and have been included in

non-recurring expenses.

A Statement of Claim was also fi led by Jetsgo Corporation in the

Ontario Superior Court on October 15, 2004, against WestJet, an

offi cer, and a former offi cer (the “Defendants”). The principal

allegations were that the Defendants conspired together to

unlawfully obtain Jetsgo’s proprietary information and to use

this proprietary information to harm Jetsgo and benefi t the

Company. The Plaintiff is seeking damages in an amount to

be determined plus $50 million, but the Plaintiff has provided

no details or evidence to substantiate its claim. On May 13,

2005, Jetsgo Corporation declared bankruptcy. As a result, this

action has been stayed and no further steps can be taken in the

litigation unless a court order is obtained.

We are party to other legal proceedings and claims that arise

during the ordinary course of business. It is the opinion of

management that the ultimate outcome of these and any

outstanding matters will not have a material effect upon our

fi nancial position, results of operations or cash fl ows.