Westjet 2006 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2006 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26 2006 | WestJet Annual Report

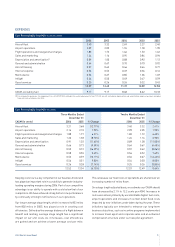

The profi t share provision amounted to $20.3 million in 2006, a

236.2% increase over the $6.0 million in the previous year, which

was directly attributable to our increased pre-tax margin.

FOREIGN EXCHANGE

On average, the Canadian dollar was stronger during 2006

compared to 2005, ending the year at $0.86, relative to the US

dollar. WestJet’s exposure to the US dollar primarily relates to

aircraft lease payments, jet fuel, airport operations at our U.S.

destinations and certain maintenance costs.

To minimize our risk in foreign-exchange movements related to

our US-dollar operating expenditures, we carry US-dollar cash

and cash equivalents to meet these obligations. On average, we

had a balance of approximately US $37 million in cash and cash

equivalents on hand throughout the year.

We estimate that for every $0.01 movement in the Canadian

dollar in relation to the US dollar (e.g., $0.86 to $0.85), our

pre-tax operating expense would change by approximately

$5.4 million.

INCOME TAXES

Our operations span several tax jurisdictions, which subjects our

income to various rates of taxation. As such, the computation

of the provision for income taxes involves judgments based

on the analysis of several different pieces of legislation and

regulations.

Our effective consolidated income tax rate for 2006 was

approximately 30% of earnings before income taxes, which was

lower than expected. During the second quarter of 2006 the

federal government, along with several provincial governments,

substantively enacted corporate tax rate reductions. The

revaluation of our future tax liability resulted in an approximate

$11.3 million recovery of future income tax expense. The

federal government also eliminated the large corporations’ tax,

effective January 1, 2006, which helped reduce our 2006 cash

tax obligation. Overall, the reductions in tax rates were offset

by higher earnings which led to an increase in a total income

tax expense of $21.8 million as compared to 2005.

Our compensation strategy

encourages employees to

become owners in our company

which inherently creates for

them a vested interest in our

accomplishments.

ALISON BRITTON

Compensation Coordinator

NANCY EATON-DOKE

Compensation Coordinator