Westjet 2003 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2003 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52 | 2003 WestJet Annual Report

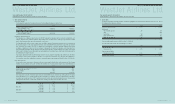

Years ended December 31, 2003 and 2002

(Tabular Amounts are Stated in Thousands of Dollars, Except Per Share Data)

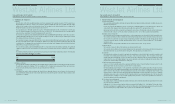

9. Financial instruments and risk management:

(a) Fuel risk management:

The Corporation periodically utilizes short-term and long-term financial and physical derivative instruments to mitigate its exposure to

fluctuations in jet fuel prices.

In 2003, the Corporation had mitigated its exposure to jet fuel price volatility through the use of long-term fixed price contracts and

contracts with a fixed ceiling price which it had entered into with a fuel supplier in 1999 and expired in June 2003.

Any premiums paid to enter into these long-term fuel arrangements are recorded as other long-term assets and amortized to fuel expense

over the term of the contracts. In 2003, this contract represented 12% (2002 - 32%) of the Corporation’s fuel requirements.

(b) Foreign currency exchange risk:

The Corporation is exposed to foreign currency fluctuations as certain ongoing expenses are referenced to US dollar denominated prices.

The Corporation periodically uses financial instruments, including foreign exchange forward contracts and options, to manage its exposure.

The Corporation has entered into a foreign exchange forward fixing agreement for the right to enter into foreign exchange forward

contracts to manage its exposure to foreign currency fluctuations on the 11 aircraft to be delivered during 2004. This agreement is

described in note 4.

Included in cash and cash equivalents at December 31, 2003 is US $29,942,000 (2002 - US $16,374,000).

(c) Interest rate risk:

The Corporation is exposed to interest rate fluctuations on variable interest rate debt.

The Corporation has the ability to enter into forward starting interest rate agreements in order to manage its interest rate exposure on

future debt related to the 11 aircraft to be delivered during 2004. These agreements are described in note 4.

(d) Credit risk:

The Corporation does not believe it is subject to any significant concentration of credit risk. Most of the Corporation’s receivables result

from tickets sold to individual guests through the use of major credit cards and travel agents. These receivables are short-term,

generally being settled shortly after the sale. The Corporation manages the credit exposure related to financial instruments by selecting

counter parties based on credit ratings, limiting its exposure to any single counter party and monitoring the market position of the

program and its relative market position with each counter party.

(e) Ontario Teachers’ Financing Agreement:

On June 26, 2003 the Corporation entered into an agreement with Ontario Teachers’ Pension Plan Board (“Ontario Teachers”) for the

right to require Ontario Teachers to purchase up to $100,000,000 of common shares.

The Financing Agreement expires August 29, 2004, and gives the Corporation the one-time right to require Ontario Teachers to purchase

common shares at 94% of the weighted average trading price for the Corporation’s shares for the 10 trading days prior to the Corporation’s

notice of exercise to Ontario Teachers. The Financing Agreement is subject to several conditions, including that Ontario Teachers is not

required to purchase common shares under the Financing Agreement which would cause their ownership to exceed 29.99% of the then

outstanding common shares and a requirement that the Corporation obtain all necessary regulatory approvals. The Corporation will

pay Ontario Teachers a standby fee of 1% per annum, payable quarterly, in advance, so long as the Corporation has not exercised or

cancelled its rights under the Financing Agreement.

(f) Fair value of financial instruments:

The carrying amounts of financial instruments included in the balance sheet, other than long-term debt, approximate their fair value

due to their short term to maturity.

At December 31, 2003, the fair value of long-term debt was approximately $667 million (2002 - $236 million). The fair value of long-

term debt is determined by discounting the future contractual cash flows under current financing arrangements at discount rates which

represent borrowing rates presently available to the Corporation for loans with similar terms and maturity.

Years ended December 31, 2003 and 2002

(Tabular Amounts are Stated in Thousands of Dollars, Except Per Share Data)

8. Commitments and contingencies:

(a) Aircraft:

Under the terms of the 10 Boeing Next-Generation aircraft lease agreements, the Corporation received a 737-700 engine for use

throughout the period of the leases. Subject to the Corporation’s compliance with the terms of the lease agreements, title to the engine

will pass to the Corporation at the end of the final lease term. The Corporation has also obtained options to lease an additional 10

Boeing Next-Generation aircraft to be delivered prior to the end of 2006.

The Corporation has also entered into agreements to purchase 39 Boeing Next-Generation aircraft, 15 of which were received by year

end 2003, with the remaining 24 to be delivered over the course of 2004 to 2006. This agreement provides the Corporation with the

option to purchase an additional 35 aircraft for delivery prior to the end of 2008.

The Corporation has signed an agreement with Aviation Partners Boeing to install Blended Winglet Technology on all 49 of the Corporation’s

committed Boeing Next-Generation 737-700 series aircraft, including leased aircraft, over the next six years, with the option to install

the technology on future aircraft deliveries as requested.

The Corporation has signed an agreement with LiveTV for a 13-year term to install, maintain and operate LiveTV on all 49 aircraft with

the option to install the system on future aircraft deliveries. After the 13-year term, the agreement is terminable by either party with

six months notice. This agreement has an exclusivity clause for five years within Canada beginning on the date that the first aircraft

with LiveTV has been approved by Transport Canada.

The Corporation has signed an agreement with Bell ExpressVu for a seven-year term to provide satellite programming. The agreement

commences on the date the first aircraft with LiveTV has been approved by Transport Canada and can be renewed for an additional five

years.

The remaining estimated amounts to be paid in deposits and purchase prices in US dollars relating to the purchases of the remaining

24 aircraft, LiveTV systems and Winglets are as follows:

2004 $ 382,368

2005 374,844

2006 32,043

$ 789,255

(b) Employee profit share:

The Corporation has an employee profit sharing plan whereby eligible employees participate in the pre-tax operating income of the Corporation.

The profit share ranges from a minimum of 10% to a maximum of 20% of earnings before employee profit share and income taxes.

The amounts paid under the plan are subject to prior approval by the Board of Directors.

(c) Contingencies:

The Corporation is party to legal proceedings and claims that arise during the ordinary course of business. It is the opinion of

management that the ultimate outcome of these matters will not have a material effect upon the Corporation’s financial position, results

of operations or cash flows.

2003 WestJet Annual Report |53

WestJet Airlines Ltd.

Notes to Consolidated Financial Statements

WestJet Airlines Ltd.

Notes to Consolidated Financial Statements