Westjet 2003 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2003 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46 | 2003 WestJet Annual Report

Years ended December 31, 2003 and 2002

(Tabular Amounts are Stated in Thousands of Dollars, Except Per Share Data)

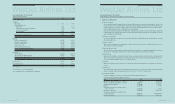

4. Long-term debt (continued):

The net book value of the property and equipment pledged as collateral for the Corporation’s secured borrowings was $810,767,000 as at

December 31, 2003 (2002 - $292,352,000).

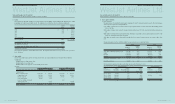

Future scheduled repayments of long-term debt are as follows:

2004 $ 59,334

2005 60,710

2006 55,578

2007 55,760

2008 60,937

2009 and thereafter 356,546

$ 648,865

As a result of the foreign exchange movement during the year, the Corporation decreased the amount of the existing Export-Import Bank of

the United States (“Ex-Im Bank”) final commitment related to the first 15 purchased Boeing 737-700 aircraft delivered in 2002 and 2003

from US $478 million to US $450 million. As at December 31, 2003 the unutilized and uncancelled balance of this loan guarantee was US

$18.4 million. This unutilized balance will be used to support the financing of Winglets and LiveTV systems to be installed on each of the

Ex-Im Bank supported aircraft in the upcoming year and will be drawn down upon completion of the installation of Winglets and LiveTV

systems on the final aircraft.

During December 2003, the Corporation converted US $358 million of the original preliminary commitment with Ex-Im Bank into a final

commitment to support the acquisition of 11 Boeing Next-Generation 737-700 with Winglets and LiveTV systems to be delivered during

2004. In addition, Ex-Im Bank has provided a preliminary commitment of US $442 million for 13 aircraft to be delivered in 2005 and 2006.

The Corporation continues to be charged a commitment fee of 0.125% per annum on the unutilized and uncancelled balance of the loan

guarantees, payable at specified dates and upon delivery of an aircraft, and is charged a 3% exposure fee on the financed portion of the

aircraft price, payable upon delivery of an aircraft.

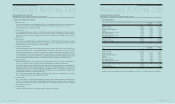

Subsequent to December 31, 2003, the Corporation completed financing arrangements for US $358 million (the “Facility”) arranged by ING

Capital LLC and including ING Bank of Canada, Fortis Capital Corp., and Société Générale (Canada) supported by loan guarantees from the

Ex-Im Bank on the 11 aircraft to be delivered during 2004. This facility will be drawn in Canadian dollars in separate instalments with 12-

year terms for each new aircraft. Each loan will be amortized on a straight-line basis over the 12-year term in quarterly principal

instalments, with interest calculated on the outstanding principal balance. The Corporation has taken delivery of the first two aircraft in

January and February 2004 and has drawn a total of $75,115,000 under this facility at an average fixed rate of interest of 4.98%. Two

special-purpose entities are used as the financial intermediaries to facilitate the financing of the Ex-Im Bank supported aircraft.

The Corporation has entered into a foreign exchange forward fixing agreement for the right to enter into foreign exchange forward contracts

to manage its exposure to foreign currency fluctuations on the next nine aircraft to be delivered during 2004. The Corporation is entitled to

lock in the foreign exchange rate up to six months in advance of delivery on US $30 million per aircraft, to an aggregate outstanding total

of US $180 million. Subsequent to December 31, 2003, the Corporation entered into foreign exchange forward contracts under this facility

totaling US $144 million at an average foreign exchange rate of 1.30, effective for the period March to June 2004, for five future aircraft

deliveries in the same period.

The Corporation has the ability to enter into forward starting interest rate agreements to fix the interest rate on the next nine aircraft to be

delivered in 2004. Subsequent to December 31, 2003 the Corporation entered into forward starting interest rate agreements at rates between

4.88% and 5.22% on five future aircraft deliveries, effective for the period May to September 2004.

The Corporation has available a facility with a Canadian chartered bank of $8,000,000 (2002 - $6,000,000) for letters of guarantee. At

December 31, 2003, letters of guarantee totaling $5,921,000 (2002 - $4,410,000) have been issued under these facilities. The credit

facilities are secured by a general security agreement and an assignment of insurance proceeds.

Cash interest paid during the year was $21,938,000 (2002 - $5,836,000).

Years ended December 31, 2003 and 2002

(Tabular Amounts are Stated in Thousands of Dollars, Except Per Share Data)

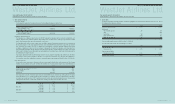

3. Other long-term assets:

Included in other long-term assets are financing fees of $22,588,000 (2002 - $8,802,000), net of accumulated amortization of $1,515,000

(2002 - $123,000) related to the facility for the purchase of 15 Boeing Next-Generation aircraft, $17,630,000 (2002 - $19,034,000) of

unamortized hedge settlements related to the 10 leased Boeing Next-Generation aircraft, security deposits on aircraft and other leaseholds

of $14,782,000 (2002 - $7,701,000), NAV Canada security deposit of $4,500,000 (2002 - $nil) and other amounts totaling $275,000 (2002

- $529,000).

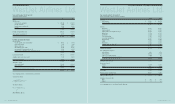

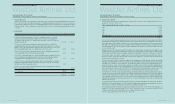

4. Long-term debt:

2003 2002

$630,579,000 in15 individual term loans, amortized on a straight-line basis over a 12-year term,

repayable in quarterly principle instalments ranging from $816,000 to $955,000, including fixed

rate weighted average interest at 5.58%, guaranteed by the Ex-Im Bank, secured by 15 aircraft, and

maturing in 2014 and 2015 $ 600,047 $ 178,777

$26,000,000 term loans, repayable in monthly instalments ranging from $110,000 to $162,000

including floating interest at the bank’s prime plus 0.88% with an effective interest rate of 5.38% as at

December 31, 2003, with varying maturities ranging between July 2008 and July 2013, secured by two

Next-Generation flight simulators and cross-collateralized by two 200 series aircraft. 23,751 15,058

$12,000,000 term loan, repayable in monthly instalments of $108,000 including fixed rate interest at

9.03%, maturing April 2011, secured by the Calgary hangar facility 11,360 11,620

$28,573,000 in seven individual term loans, repayable in monthly instalments ranging from $25,000 to

$133,000 including fixed rate weighted average fixed rate interest at 8.42% with varying maturities

ranging between May 2004 through October 2005, secured by four 200 series aircraft 9,390 14,626

$4,550,000 term loan repayable in monthly instalments of $50,000 commencing May 2003, including

floating interest at the bank’s prime plus 0.50%, with an effective interest rate of 5.00%, maturing

April 2013, secured by the Calgary hangar facility 4,317 -

$11,589,000 term loan, repayable in monthly instalments of $1,311,000, including fixed rate interest of

4.40%, which matured in September 2003 - 11,589

648,865 231,670

Less current portion 59,334 32,674

$ 589,531 $ 198,996

2003 WestJet Annual Report |47

WestJet Airlines Ltd.

Notes to Consolidated Financial Statements

WestJet Airlines Ltd.

Notes to Consolidated Financial Statements