Westjet 2003 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2003 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 | 2003 WestJet Annual Report

Years ended December 31, 2003 and 2002

(Tabular Amounts are Stated in Thousands of Dollars, Except Per Share Data)

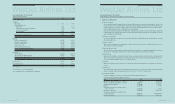

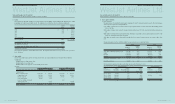

7. Income taxes:

Income taxes vary from the amount that would be computed by applying the basic Federal and Provincial tax rate of 37.96% (2002 - 38.1%)

to earnings before income taxes as follows:

2003 2002

Expected income tax provision $ 36,975 $ 31,544

Add (deduct):

Non-deductible expenses 748 518

Other - (358)

Capital taxes 548 31

Large corporations tax 1,111 177

Future tax rate reductions (2,526) (848)

$ 36,856 $ 31,064

Cash taxes paid during the year were $9,426,000 (2002 - $3,878,000).

The components of the net future income tax liability are as follows:

2003 2002

Future income tax asset:

Share issue costs $ 2,776 $ 1,767

Future income tax liability:

Property and equipment 64,199 39,804

Net future income tax liability $ 61,423 $ 38,037

Years ended December 31, 2003 and 2002

(Tabular Amounts are Stated in Thousands of Dollars, Except Per Share Data)

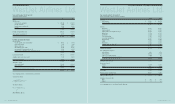

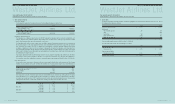

6. Share capital (continued):

(d) Per share amounts:

The following table summarizes the common shares used in calculating net earnings per common share:

2003 2002

Weighted average number of common

shares outstanding - basic 76,980,309 73,942,259

Effect of dilutive employee stock options 1,323,231 1,339,511

Weighted average number of common

shares outstanding - diluted 78,303,540 75,281,770

(e) Employee Share Purchase Plan:

The Corporation has an Employee Share Purchase Plan (“ESPP”) whereby the Corporation matches every dollar contributed by each

employee. Under the terms of the ESPP, employees may contribute up to a maximum of 20% of their gross pay and acquire common

shares of the Corporation at the current fair market value of such shares.

The Corporation has the option to acquire common shares on behalf of employees through open market purchases or from treasury at

the current market price. For the period January to April 2003, shares under the ESPP were issued from treasury at the current market

price. Included in Share Capital is $3,063,000 of common shares representing the Corporation’s matching contribution from treasury

for employee contributions, for which no cash was exchanged. Subsequent to this period, the Corporation elected to purchase these

shares through the open market and will continue to review this option in the future. Current market price for common shares issued

from treasury is determined based on the weighted average trading price of the common shares on the Toronto Stock Exchange for the

five trading days preceding the issuance.

Shares may be withdrawn from the Plan after being held in trust for one year. Employees may offer to sell common shares, which have

not been held for at least one year, on January 1 and July 1 of each year, to the Corporation for 50% of the then current market price.

The Corporation’s share of the contributions is recorded as compensation expense and amounted to $13,824,000 (2002 - $10,178,000).

(f) Pro forma disclosure:

The fair value of each option grant is estimated on the date of grant using the Black-Scholes option pricing model. The following

weighted average assumptions were used to determine the fair market value of options granted during the years ended December 31:

2003 2002

Weighted average fair market value per option $5.69 $8.06

Average risk-free interest rate 3.9% 4.5%

Average volatility 40% 38%

Expected life Four years Four years

Had compensation cost for the Corporation’s stock option plan been determined based on the fair value at the grant dates for options

granted after January 1, 2002, consistent with the fair value based method of accounting for stock-based compensation, the Corporation’s

net earnings and earnings per share (“EPS”) would have been reduced to the pro forma amounts indicated below. These pro forma

earnings reflect compensation cost amortized over the options’ vesting period, which varies from two to three years.

2003 2002

Net earnings As reported $ 60,539 $ 51,780

Pro forma $ 53,239 $ 48,963

Basic EPS As reported $ 0.79 $ 0.70

Pro forma $ 0.69 $ 0.66

Diluted EPS As reported $ 0.77 $ 0.69

Pro forma $ 0.68 $ 0.65

2003 WestJet Annual Report |51

WestJet Airlines Ltd.

Notes to Consolidated Financial Statements

WestJet Airlines Ltd.

Notes to Consolidated Financial Statements