Westjet 2003 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2003 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Kristie Silk, CSA,

Winnipeg: She used to

play ringette and

baseball. Her biggest

accomplishment is

working for WestJet.

John Bart, Business Analyst: He likes to salsa dance

and is a burgeoning jazz singer.

Shannon Lamb, Analyst: She likes African dance,

synchronized swimming and painting.

We have decreased the final

Ex-Im Bank commitment we

acquired in 2002 from US $478

million to US $450 million. Any

unutilized and uncancelled portion of the

final commitment is subject to a commitment

fee of 0.125% per annum. As a result of the

strengthening Canadian dollar during the year,

coupled with the commitment fee charged,

we cancelled the portion of the final Ex-Im

Bank commitment we reasonably believed the

Company would not draw on.

The Corporation has been able to benefit from low-cost

long-term financing supported by Ex-Im Bank loan

guarantees. To facilitate these financing arrangements

for our aircraft, we use two special purpose entities

that act as financial intermediaries for the Company.

Although we do not have an equity ownership

in these entities, we do primarily benefit from

their operations. Consequently, we have

included the accounts of the special-

purpose entities in our consolidated financial

statements.

when events and circumstances indicate that the assets

may be impaired.

We make estimates in accounting for our liability related

to certain types of non-refundable guest credits. We may

issue future travel credits related to guest compensation

for flight delays, missing baggage and other incon-

veniences as a gesture of good faith. These types of credits

are non-refundable and expire one year from the date of

issue. We record a liability based on the estimated

incremental cost of a one-way flight in the period the

credit is issued. The utilization of guest credits is recorded

as revenue when the guest has flown or upon expiry.

Outlook

WestJet will continue to meet the needs of all

stakeholders by actively seeking opportunities that

will allow us to successfully position ourselves to

be the leader in the high-efficiency, low-fare

environment. As we await the outcome of

Air Canada’s bankruptcy proceedings, we will

continue to proceed with caution and conservatism

during these uncertain times within the

airline industry.

2004 will be an important year for

WestJet, as it will be the first

year we welcome the transborder

market into our scheduled route

network, while at the same time

expanding the markets we serve

within Canada. We will continue

to strive to decrease unit costs,

increase operating efficiency,

provide a high quality differen-

tiated product at a low cost, and

deliver exceptional customer service

to our valued guests.

In our eight years of operation, the

Canadian airline industry has

undergone substantial changes. With

the challenges these changes bring,

new opportunities always arise. Our

motivated team of people is continually

poised to tackle these challenges to

seize the opportunities that our shifting

environment makes possible.

+

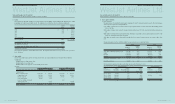

we successfully executed 12-year financing arrangements

at rates between 4.88% and 5.22%.

Since we have been able to achieve such low interest rate

terms on the majority of our debt, we consider that the most

appropriate measure of our leverage is the times interest

earned ratio, calculated as NIBIT/interest expense. At 2003

year-end, this ratio was strong at 4.91, demonstrating the

Company’s ability to sufficiently support its debt service cost

through its earnings.

We anticipate that current interest rate trends will continue

to decrease in the short-term and present us with positive

opportunities to lock in our remaining aircraft deliveries at

low interest rates similar to rates we are realizing on current

aircraft financing agreements.

Commencing January 1, 2004, WestJet is required to

formally assess all hedging relationships to determine

whether the hedging criteria required under Canadian

generally accepted accounting principles are met. These

criteria include the identification, designation and formal

documentation of hedging relationships, and assessment

of the effectiveness of the hedging relationship. WestJet

does not anticipate the new guideline to have an impact

on the Corporation’s accounting for hedges.

Critical Accounting Estimates

Critical accounting estimates are defined as those that

require the Company to make assumptions about matters

that are highly uncertain at the time the accounting

estimates are made, and potentially result in materially

different results under different assumptions and

conditions. For further discussion of these and other

accounting policies we follow, see Note 1 to our

consolidated financial statements.

We make estimates about the expected useful lives,

projected residual values and the potential for impairment

of our property and equipment. In estimating the lives and

expected residual values of our fleet of aircraft, WestJet

has relied upon annual independent appraisals,

recommendations from Boeing, and actual experience with

the same aircraft types. Revisions to the estimates for our

fleet can be caused by changes in the utilization of the

aircraft or changing market prices of used aircraft of the

same type. We evaluate our estimates and potential

impairment on all property and equipment annually and

Two-year charter agreement reached with Transat A.T. Inc. on August 20, 2003.

34 | 2003 WestJet Annual Report

+

In January 2004, WestJet secured financing arrangements

for US $358 million arranged by ING Capital LLC and

including ING Bank of Canada, Fortis Capital Corp., and

Sociéte Générale (Canada). This facility can be drawn in

Canadian dollars and fixed at a foreign exchange rate up to

six months in advance of delivery through the use of foreign

exchange forward fixing agreements. The Corporation has

vastly reduced its exposure to foreign currency fluctuations

on the purchases of Boeing Next-Generation aircraft since

debt to finance the aircraft is denominated in Canadian

dollars. Subsequent to year-end, the Corporation locked in

US $144 million at an average foreign exchange rate of

1.30 for the purchase of five aircraft to be delivered during

March to June 2004.

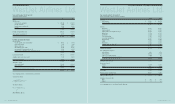

In 2002, WestJet locked in the interest rates on its first 15

purchased aircraft by entering into forward starting interest

rate agreements at rates between 5.25% and 5.85%,

successfully eliminating its exposure to interest rate

fluctuations on the financing of those aircraft during 2003.

We continue to take advantage of the low interest rate

environment in 2004 and locked in the interest rate on our

first five aircraft deliveries of 2004. By entering into forward

starting interest rate agreements under this new facility,

We continue to take advantage of the

low interest rate environment in 2004...

October 15, 2003: $144.0 million (net) share offering completed.

12 21 22201918

5.42% Average

17161514131211109876543

Fixed Interest Rates on Aircraft Financing

Aircraft Deliveries up to December 31, 2003 2004 Aircraft Deliveries

4.00%

4.25%

4.50%

4.75%

5.00%

5.25%

5.50%

5.75%

6.00%

2003 WestJet Annual Report |35