Westjet 2003 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2003 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 | 2003 WestJet Annual Report

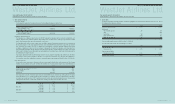

Years ended December 31, 2003 and 2002

(Tabular Amounts are Stated in Thousands of Dollars, Except Per Share Data)

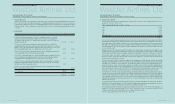

1. Significant accounting policies:

(a) Basis of presentation:

These consolidated financial statements include the accounts of the Corporation and its wholly owned subsidiaries, as well as the

accounts of two special-purpose entities which are utilized to facilitate the financing of aircraft (see note 4). The Corporation has no

equity ownership in the special-purpose entities, however, the Corporation is the primary beneficiary of the special-purpose entities’

operations. All intercompany balances and transactions have been eliminated.

The preparation of financial statements in conformity with accounting principles generally accepted in Canada requires management

to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual

results could differ from these estimates.

(b) Cash and cash equivalents:

Cash and cash equivalents are comprised of cash and all investments that are highly liquid in nature and generally have a maturity

date of three months or less.

(c) Revenue recognition:

Guest revenue is recognized when air transportation is provided. Tickets sold but not yet used are included in the balance sheet as

advance ticket sales under current liabilities.

(d) Non-refundable guest credits:

The Corporation, under certain circumstances, may issue future travel credits which are non-refundable and which expire one year from

the date of issue. The utilization of guest credits is recorded as revenue when the guest has flown or upon expiry.

(e) Foreign currency:

Monetary assets and liabilities, denominated in foreign currencies, are translated into Canadian dollars at rates of exchange in effect

at the balance sheet date. Non-monetary assets and revenue and expense items are translated at rates prevailing when they were acquired

or incurred. Foreign exchange gains and losses are included in earnings.

(f) Inventory:

Materials and supplies are valued at the lower of cost and replacement value. Aircraft expendables and consumables are expensed as

acquired.

(g) Deferred costs:

Sales and marketing and reservation expenses attributed to advance ticket sales are deferred and expensed in the period the related

revenue is recognized. Included in prepaid expenses are $5,334,000 (2002 - $4,161,000) of deferred costs.

(h) Property and equipment:

Property and equipment are recorded at cost and depreciated to their estimated residual values.

Costs of new route development are expensed as incurred.

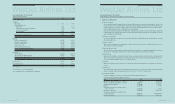

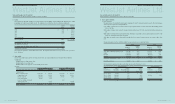

Asset Basis Rate

Aircraft net of estimated residual value – 700 series Cycles Cycles flown

Aircraft net of estimated residual value – 200 series Flight hours Hours flown

Ground property and equipment Straight-line 5 to 25 years

Buildings Straight-line 40 years

Spare engines and parts net of estimated residual

value – 700 series Straight-line 20 years

Aircraft under capital leases Straight-line Term of lease

Spare engines and parts net of estimated residual

value – 200 series Flight hours Fleet hours flown

Leasehold improvements Straight-line Term of lease

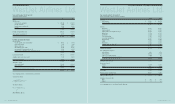

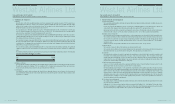

Years ended December 31, 2003 and 2002

(Stated in Thousands of Dollars)

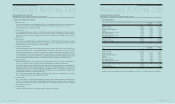

2003 2002

Cash provided by (used in):

Operations:

Net earnings $ 60,539 $ 51,780

Items not involving cash:

Amortization 63,208 52,637

Gain on disposal of property and equipment (631) (97)

Issued from treasury stock 3,063 -

Future income tax 25,592 18,438

151,771 122,758

Decrease in non-cash working capital 40,646 38,866

192,417 161,624

Financing:

Increase in long-term debt 466,353 190,366

Repayment of long-term debt (49,158) (8,471)

Issuance of common shares 165,545 84,634

Share issuance costs (6,297) (3,672)

Increase in other long-term assets (25,101) (32,257)

Decrease in obligations under capital lease (6,498) (6,088)

544,844 224,512

Investments:

Aircraft additions (564,130) (320,871)

Other property and equipment additions (34,249) (24,031)

Other property and equipment disposals 2,092 234

(596,287) (344,668)

Increase in cash 140,974 41,468

Cash, beginning of year 100,410 58,942

Cash, end of year $ 241,384 $ 100,410

Cash is defined as cash and cash equivalents.

See accompanying notes to consolidated financial statements.

2003 WestJet Annual Report |43

WestJet Airlines Ltd.

Notes to Consolidated Financial Statements

WestJet Airlines Ltd.

Consolidated Statements of Cash Flows