Westjet 2003 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2003 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet’s ESPP allows WestJetters to voluntarily

contribute up to 20% of their base salary towards the

purchase of common shares, which are matched dollar

for dollar by the company. This system has worked

extremely well at encouraging people to become WestJet

shareholders, thus aligning personal financial goals with

those of the company. Since 1999, an increasing percentage

of WestJetters have made the choice to participate. Not only

do our people think like business owners ... they are!

With commencement of service to Newfoundland in June 2003, WestJet's network spans Canada coast to coast for the first time.

28 | 2003 WestJet Annual Report

+

June 26, 2003: WestJet guests gain ability to earn AIR MILES®reward miles when booking on westjet.com. 2003 WestJet Annual Report |29

+

Compensation

Our growing business is sustained by the increasing

number of people we add to our team. Notwithstanding the

increase in our workforce, we have realized economies of

scale as our capacity increases and we achieve improvements

in operating efficiencies. Salary and benefit costs continue

to show declines in cost per ASM with an 8.9% reduction

in 2003 over 2002 from 2.4 cents to 2.2 cents.

The Employee Share Purchase Plan is a means for WestJetters

to take part in the Company’s success. WestJetters have

the option to contribute up to 20% of their salary towards

the purchase of WestJet shares, which are matched dollar for

dollar by the Company. Participation in the plan continues

to increase, with over 87% of our employees contributing

on average 13% of their salary towards the purchase of

WestJet shares. WestJet’s matching contribution expense

increased 35.3% from $10.2 million in 2002 to $13.8

million in 2003.

WestJet’s success is owed in large part to the hard work

and dedication of our team of exceptional people, and

when our airline is profitable, our employees share in this

financial success as part of our profit sharing plan. In

2003 approximately $15 million was paid to employees

in profit share, bringing the cumulative total profit share

incurred to over $60 million over the near-eight years of

our operations. Approximately 3,400 WestJetters received

an average of 13% of their salary through profit share

payments in 2003.

The Canadian Institute of Chartered Accountants recently

introduced new accounting standards for stock-based

compensation. Beginning January 1, 2004, all stock-based

compensation must be measured and recognized based on

the fair value of the instruments and expensed in the

financial statements. The Company intends to adopt the

changes retroactively on January 1, 2004, which will

result in retained earnings decreasing by $10.1 million.

Foreign Exchange

We realized a foreign exchange loss of $1.8 million in 2003

as a result of the strengthening of the Canadian dollar

throughout the year. We incur a portion of our expenditures

in US dollars (e.g. certain maintenance costs) and as a

result, we carry US-dollar cash and cash equivalents to

mitigate the effects of the foreign-exchange movement on

these costs. At year-end 2003, we had US $29.9 million

disruptions, and also from increased use of our Internet

distribution channel.

With less mechanical delays, we incur fewer costs to

accommodate our guests for inconveniences, and maintain

our excellent on-time performance (“OTP”), an important

measure of the reliability of an air carrier. A flight is

considered to be “on time” if it arrives at the gate of its

scheduled destination within 15 minutes of its scheduled

arrival time. In 2003, WestJet ranked second in OTP

among all reporting airlines in North America based on

the US Department of Transportation OTP data for

commercial airlines.

In addition to reliability, we provide our guests with a

convenient, hassle-free method to book their travel plans

through our investment in technology, such as our enhanced

platform for e-commerce growth. Continuous improvements

to our online service for both the public and travel agent

community led to an increase in Internet bookings year over year.

WestJet’s success is owed in large part to the hard

work and dedication of our team of exceptional people...

IT IS OUR CHOICES

THAT SHOW WHAT

WE TRULY ARE,

FAR MORE THAN

OUR ABILITIES.

~J.K. Rowling

in cash and cash equivalents. Also, we have US-dollar

liabilities related to our aircraft capital leases totalling US

$10.3 million at year-end, which slightly offset the impact of

the foreign-exchange-rate movement on our US-dollar cash.

We estimate for each $0.01 change in the Canadian dollar in

relation to the US dollar, the expense to WestJet increases or

decreases by approximately $2.6 million. For example, if the

Canadian dollar weakens from $0.74 to $0.73, our operating

expenses would increase by $2.6 million. Conversely, if the

Canadian dollar strengthens from $0.73 to $0.74, our

operating expenses would decrease by $2.6 million. The

impact of the foreign exchange rate movement on our US

dollar cash will have an offsetting effect to this

increase or decrease in operating expenses.

Income Taxes

Our 2003 overall effective tax rate of 37.8% is

an increase from 37.5% in 2002, and is higher

than the expected rate of 35.2% as reported in the

2002 MD&A. This was caused by the Ontario

government introducing Bill 2, An Act Respecting

Fiscal Responsibility 2003 on November 24, 2003.

The legislation repeals Ontario’s general tax reductions

that were scheduled for January 1, 2004, 2005 and

2006. Instead, effective January 1, 2004, Ontario’s

general corporate rate increased from 12.5% to

14.0%. This change required us to revalue the

entire future tax liability on our balance sheet in the

fourth quarter of 2003, which led to a fourth

quarter charge to our future income tax expense

of $2.3 million. Excluding this adjustment, the

2003 overall effective tax rate would have

been 35.5%. With our adoption of the new

stock option rules for 2004, we expect a

2004 overall effective tax rate of

approximately 38.5%.

Financial Condition

WestJet finished the year with

a generous cash balance

of $241.4 million, in

comparison to $100.4

million at December

31, 2002. Throughout

the year we maintained a

strong working capital ratio.

Cherri Laface, Trainer:

She enjoys Pilates, jogging,

salads and “chick flicks”.

Bookings at westjet.com grew from approximately 55% at

the end of 2002 to approximately 70% by the end of 2003.

With this increase in online bookings, we saw an expected

decline in bookings on some of our higher-cost channels.

Bookings in our call centre have decreased to 25% of total

sales volume in 2003 compared to 37% in 2002.

The Internet distribution channel is a lower-cost, higher-

margin method to distribute our product. In September, we

increased our web fare discount from $5 to $6 on round-

trip bookings to encourage our guests to book online.

Non-travel agent bookings have increased from 28.5% of

net online bookings in 2002 to 40.6% in 2003.

With the introduction of our AIR MILES program, we further

made the Internet an attractive alternative booking method.

Following introduction of this program in June 2003, our

online bookings on westjet.com increased approximately

seven-percentage points by year-end 2003.

Christine Jodoin, Team Leader, Montréal:

She likes music, wine, fine dining, and can

juggle with her hands and feet. The popularity of our

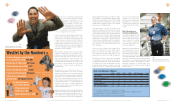

Employee Share Purchase Plan

continues to grow!

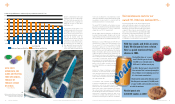

Percentage of WestJetters

participating in the ESPP:

1999 - 69.4%

2000 - 81.4%

2001 - 82.0%

2002 - 86.0%

2003 - 87.1%