Vonage 2012 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2012 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-26 VONAGE ANNUAL REPORT 2012

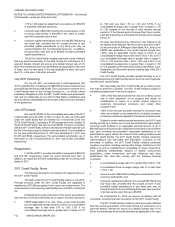

documentation for our 2008 credit facility) that was fully accepted and

allowed us to prepay, without premium, specified amounts, holders did

not fully accept our consolidated excess cash flow offer in July 2010,

indicating our ability to continue to repay debt at par was no longer

likely. We also determined that we could obtain financing at acceptable

terms, which along with our existing cash on hand, would be sufficient

to repurchase our prior senior secured first lien credit facility and our

prior senior secured second lien credit facility including any amounts

due pursuant to the make-whole premiums. Based upon these factors

and our valuation analysis, our prior senior secured first lien credit facility

and our prior senior secured second lien credit facility make-whole

premiums were estimated to have a fair value of $60,000 as of

September 30, 2010 and had a nominal fair value as of December 31,

2009. This value was increased in the fourth quarter of 2010 to $91,686

to reflect the actual value that was ultimately paid in December 2010.

Although management believed its valuation methods were

appropriate and consistent with other market participants, the use of

different methodologies or assumptions to determine the fair value of

certain financial instruments could have resulted in a different fair value

measurement at the reporting date.

Fair Value of Other Financial Instruments

The carrying amounts of our financial instruments, including

cash and cash equivalents, accounts receivable, and accounts payable,

approximate fair value because of their short maturities. The carrying

amounts of our capital leases approximate fair value of these obligations

based upon management’s best estimates of interest rates that would

be available for similar debt obligations at December 31, 2012 and 2011.

We believe the fair value of our debt at December 31, 2012 was

approximately the same as its carrying amount as market conditions,

including available interest rates, credit spread relative to our credit

rating, and illiquidity, remain relatively unchanged from the issuance

date of our debt on July 29, 2011 for a similar debt instrument.

Note 8. Common Stock

Net Operating Loss Rights Agreement

On June 7, 2012, we entered into a Tax Benefits Preservation

Plan ("Preservation Plan") designed to preserve stockholder value and

tax assets. Our ability to use our tax attributes to offset tax on U.S.

taxable income would be substantially limited if there were an

"ownership change" as defined under Section 382 of the U.S. Internal

Revenue Code. In general, an ownership change would occur if one or

more "5-percent shareholders," as defined under Section 382,

collectively increase their ownership in us by more than 50 percent over

a rolling three-year period.

In connection with the adoption of the Preservation Plan, our

board of directors declared a dividend of one preferred share purchase

right for each outstanding share of the Company’s common stock. The

preferred share purchase rights were distributed to stockholders of

record as of June 18, 2012, as well as to holders of the Company's

common stock issued after that date, but will only be activated if certain

triggering events under the Preservation Plan occur.

Under the Preservation Plan, preferred share purchase rights

will work to impose significant dilution upon any person or group which

acquires beneficial ownership of 4.9% or more of the outstanding

common stock, without the approval of our board of directors, from and

after June 7, 2012. Stockholders that own 4.9% or more of the

outstanding common stock as of the opening of business on June 7,

2012, will not trigger the preferred share purchase rights so long as they

do not (i) acquire additional shares of common stock or (ii) fall under

4.9% ownership of common stock and then re-acquire shares that in

the aggregate equal 4.9% or more of the common stock.

The Preservation Plan will expire no later than the close of

business June 7, 2013, unless extended by our board of directors. Any

extension would be subject to approval by stockholders at the 2013

annual meeting.

Common Stock Repurchases

On July 25, 2012, our board of directors authorized a program

to repurchase up to $50,000 of Vonage common stock through

December 31, 2013. On February 7, 2013, Vonage's Board of Directors

discontinued this share repurchase program effective at the close of

business on February 12, 2013 with $16,682 remaining, and authorized

a new program to repurchase up to $100,000 of the Company's

outstanding shares by December 31, 2014. The specific timing and

amount of repurchases will vary based on available capital resources

and other financial and operational performance, market conditions,

securities law limitations, and other factors. The repurchases will be

made using our cash resources. The repurchase program may be

commenced, suspended or discontinued at any time without prior notice.

In any period, cash used in financing activities related to common stock

repurchased may differ from the comparable change in stockholders'

equity, reflecting timing differences between the recognition of share

repurchase transactions and their settlement for cash.

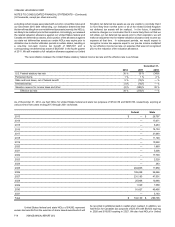

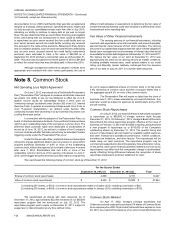

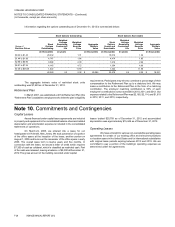

We repurchased the following shares of common stock as of December 31, 2012:

For the Quarter Ended

September 30, 2012 (1) December 31, 2012 (2) Total

Shares of common stock repurchased 4,090 8,157 12,247

Value of common stock repurchased $ 9,055 $ 18,889 $ 27,944

(1) including 307 shares, or $700, of common stock repurchases settled in October 2012; excluding commission of $82.

(2) including 278 shares, or $638, of common stock repurchases settled in January 2013; excluding commission of $163.

We repurchased all shares with cash resources. As of

December 31, 2012, approximately $22,056 remained of our $50,000

repurchase program that we announced on July 25, 2012. The

repurchase program was to expire on December 31, 2013, subject to

suspension or discontinuation at any time without notice.

Common Stock Warrant

On April 17, 2002, Vonage’s principal stockholder and

Chairman received a warrant to purchase 514 shares of Common Stock

at an exercise price of $0.70 per share that would have expired on June

20, 2012. As a result of the issuance of our prior Convertible Notes, the

VONAGE HOLDINGS CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)