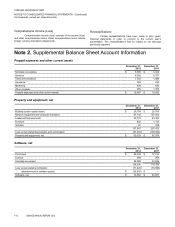

Vonage 2012 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2012 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.F-11 VONAGE ANNUAL REPORT 2012

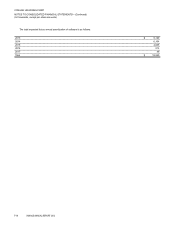

Software Costs

We capitalize certain costs, such as purchased software and

internally developed software that we use for customer acquisition and

customer care automation tools, in accordance with FASB ASC 350-40,

“Internal-Use Software”. Computer software is stated at cost less

accumulated amortization and the estimated useful life is two to five

years.

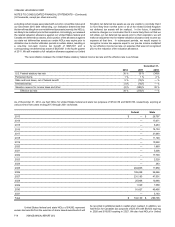

As previously disclosed, we experienced delays and

incremental costs during the course of the development and

implementation of a new billing and ordering system by Amdocs

Software Systems Limited and Amdocs, Inc. (collectively, "Amdocs")

and the transition of customers to the system. We conducted

discussions with Amdocs to resolve the issues associated with the billing

and ordering system. Based on these discussions, and after our

consideration of the progress made improving our overall IT

infrastructure, the incremental time and costs to develop and implement

the Amdocs system, as well as the expected reduction in capital

expenditures, in June 2012 we and Amdocs determined that terminating

the program was in the best interest of both parties. On July 30, 2012,

we entered into a Settlement Agreement with Amdocs terminating the

related license agreement. As a result, we wrote off our investment in

the system of $25,262, net of settlement amounts to us, in the second

quarter of 2012. This charge is recorded as loss from abandonment of

software assets in the statement of operations.

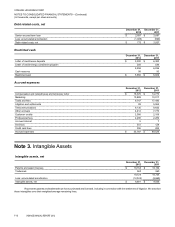

Intangible Assets

Intangible assets acquired in the settlement of litigation or by

direct purchase are accounted for based upon the fair value of assets

received.

Patents and Patent Licenses

Patent rights acquired in the settlement of litigation or by direct

purchase are accounted for based upon the fair value of assets received.

Long-Lived Assets

We evaluate impairment losses on long-lived assets used in

operations when events and changes in circumstances indicate that the

assets might be impaired. If our review indicates that the carrying value

of an asset will not be recoverable, based on a comparison of the carrying

value of the asset to the undiscounted future cash flows, the impairment

will be measured by comparing the carrying value of the asset to its fair

value. Fair value will be determined based on quoted market values,

discounted cash flows or appraisals. Impairments are recorded in the

statement of operations as part of depreciation expense.

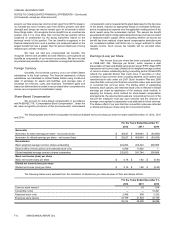

Debt Related Costs

Costs incurred in raising debt are deferred and amortized as

interest expense using the effective interest method over the life of the

debt.

Restricted Cash and Letters of Credit

We had a cash collateralized letter of credit for $5,300 and

$6,300 as of December 31, 2012 and 2011, respectively, related to lease

deposits for our offices and a cash collateralized letter of credit for $258

and $536 as of December 31, 2012 and 2011, respectively, related to

an energy curtailment program for our offices. The total amount of

collateralized letters of credit was $5,558 and $6,836 at December 31,

2012 and 2011, respectively. In the aggregate, cash reserves and

collateralized letters of credit of $5,656 and $6,929 were recorded as

long-term restricted cash at December 31, 2012 and 2011, respectively.

Derivatives

We do not hold or issue derivative instruments for trading

purposes. However, in accordance with FASB ASC 815, “Derivatives

and Hedging” (“FASB ASC 815”), we review our contractual obligations

to determine whether there are terms that possess the characteristics

of derivative financial instruments that must be accounted for separately

from the financial instrument in which they are embedded. In 2011 and

2010, based upon this review, we were required to value the following

features separately for accounting purposes:

> certain features within a prior common stock warrant to purchase

514 shares of common stock at an exercise price of $0.58

because the number of shares to be received by the holder could

change under certain conditions;

> certain features within our prior third lien convertible notes

because the number of shares to be received by the holder could

have changed under certain conditions; and

> the make-whole premium provisions within our prior senior

secured first lien credit facility and our prior senior secured

second lien credit facility because upon prepayment under

certain circumstances we may have been required to settle the

debt for more than its face amount.

We recognized these features as liabilities in our consolidated

balance sheet at fair value each period and recognized any change in

the fair value in our statement of operations in the period of change. We

estimated the fair value of these liabilities using available market

information and appropriate valuation methodologies.

Income Taxes

We recognize deferred tax assets and liabilities at enacted

income tax rates for the temporary differences between the financial

reporting bases and the tax bases of our assets and liabilities. Any effects

of changes in income tax rates or tax laws are included in the provision

for income taxes in the period of enactment. Our net deferred tax assets

primarily consist of net operating loss carry forwards (“NOLs”). We are

required to record a valuation allowance against our net deferred tax

assets if we conclude that it is more likely than not that taxable income

generated in the future will be insufficient to utilize the future income tax

benefit from our net deferred tax assets (namely, the NOLs) prior to

expiration. We periodically review this conclusion, which requires

significant management judgment. If we are able to conclude in a future

period that a future income tax benefit from our net deferred tax assets

has a greater than 50 percent likelihood of being realized, we are

required in that period to reduce the related valuation allowance with a

corresponding decrease in income tax expense. This will result in a

non-cash benefit to our net income in the period of the determination.

In the fourth quarter of 2011, we released $325,601 of valuation

allowance (see Note 5. Income Taxes). We periodically review this

conclusion, which requires significant management judgment. In the

future, if available evidence changes our conclusion that it is more likely

than not that we will utilize our net deferred tax assets prior to their

expiration, we will make an adjustment to the related valuation allowance

and income tax expense at that time. In subsequent periods, we would

expect to recognize income tax expense equal to our pre-tax income

multiplied by our effective income tax rate, an expense that was not

recognized prior to the reduction of the valuation allowance. Our

effective rate may differ from the federal statutory rate due, in part, to

our Canadian operations and certain discrete period items, which in

2012 primarily consisted of adjustments related to stock compensation,

including a non-cash deferred tax adjustment totaling $4,077 in 2012

for certain stock compensation previously considered

nondeductible under Section 162(m) of the Internal Revenue Code.

We file income tax returns in the U.S. on a federal basis and

in U.S. state and foreign jurisdictions. Our federal tax return remains

subject to examination by the Internal Revenue Service from 2007 to

VONAGE HOLDINGS CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)