Vonage 2012 Annual Report Download - page 77

Download and view the complete annual report

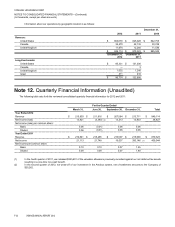

Please find page 77 of the 2012 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.F-24 VONAGE ANNUAL REPORT 2012

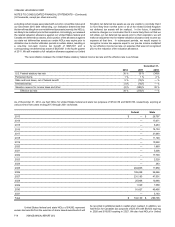

Senior Facility less $4,655 required to prepay amounts under the First

Lien Senior Facility prepayment offer. While certain holders of loans

under the Second Lien Senior Facility waived their right to receive the

prepayment as permitted under the Credit Documentation, $13,281 was

paid on July 21, 2010 to holders that did not waive the prepayment, who

were affiliates or associates of the Company's directors. Of this amount

$13,128 was applied to the outstanding principal balance of which

$3,668 represents payment of PIK interest, which was recorded as a

component of cash flows from financing activities, and $153 was applied

to accrued but unpaid interest. A loss on extinguishment of $813,

representing acceleration of unamortized debt discount, debt related

costs, and administrative agent fees of $472, $325 and $16,

respectively, was recorded in the three-month period ended

September 30, 2010 as a result of the prepayment.

Other Prepayments under First Lien Senior Facility and

Second Lien Senior Facility

The First Lien Senior Facility and Second Lien Senior Facility

included make-whole premiums that were bifurcated from the underlying

debt instrument and valued as a separate financial instrument because

the economic and risk characteristics of the make-whole premiums meet

the criteria for separate accounting as set forth in FASB ASC 815. The

First Lien Senior Facility and Second Lien Senior Facility make-whole

premiums were paid on December 14, 2010.

Third Lien Convertible Notes

Subject to conversion, repayment or repurchase of the

Convertible Notes, the Convertible Notes were to mature in October

2015. Subject to customary anti-dilution adjustments (including triggers

upon the issuance of common stock below the market price of the

common stock or the conversion price of the Convertible Notes), the

Convertible Notes were convertible into shares of our common stock at

a rate equal to 3,448.2759 shares for each $1,000 principal amount of

Convertible Notes, or approximately $0.29 per share. As of December

31, 2010, all of the outstanding $18,000 principal amount of Convertible

Notes were converted into 62,069 shares of our common stock. In

connection with note conversions during the year ended December 31,

2010, $2,258 was paid for accrued interest.

In accordance with guidance codified in FASB ASC 815,

which was effective January 1, 2009, we determined that the Convertible

Notes contained an embedded derivative that required separate

valuation from the Convertible Notes because an anti-dilution

adjustment would have been triggered upon the issuance of common

stock by us below the conversion price of the Convertible Notes. As

explained below, we recognized this embedded derivative as a liability

in our consolidated balance sheet at its fair value each period and

recognized any change in the fair value in our statement of operations

in the period of change. The fair value of the embedded derivative was

determined using the Monte Carlo simulation model. The key inputs in

the model were maturity date, risk-free interest rate, current share price

and historical volatility of our common stock.

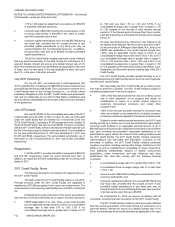

In accordance with FASB ASC 815, we determined the fair

value of the conversion feature and recorded applicable amounts as

follows:

Issuance. The fair value of the conversion feature at issuance

was $39,990 which, upon the adoption of FASB ASC 815, was recorded

as a liability with a corresponding reduction in additional-paid-in capital

of $37,884, which was the premium originally recorded at issuance. The

remaining $2,106 was recorded as a discount to be amortized to interest

expense over the life of the debt using the effective interest method.

Accumulated amortization of the discount was $2,106 as of December

31, 2010, including a $515 acceleration of unamortized discount on

notes related to the conversion of Convertible Notes for the year ended

December 31, 2010. Amortization for the year ended December 31,

2010 was $50.

December 31, 2008. The fair value of the conversion feature

at December 31, 2008 was $32,720. The $7,270 difference between

the fair value of the conversion feature at December 31, 2008 and the

issuance date, together with the$47 amortization of the discount for the

period ended December 31, 2008, were recorded as an adjustment to

the opening balance of retained earnings that was recognized as a

cumulative effect of a change in accounting principle as of January 1,

2009 in accordance with FASB ASC 815.

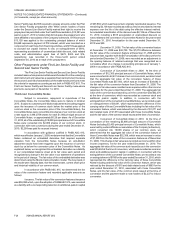

Conversion of Convertible Notes in 2009. At the time of

conversions of $12,305 principal amount of Convertible Notes, which

were converted into 42,431 shares of our common stock, we determined

that the aggregate fair value of the conversion feature of those

Convertible Notes was $57,050, which was an increase of $34,682 in

the fair value of the conversion feature from December 31, 2008. The

changes in fair value were recorded as an expense within other income

(expense) for the year ended December 31, 2009. The aggregate fair

value of the common stock issued by us in the conversion was $62,370

at the time of conversion, which was recorded as common stock and

additional paid-in capital. In addition, in connection with the

extinguishment of the converted Convertible Notes, we recorded a gain

on extinguishment of $4,041, which represented the difference in the

carrying value of those Convertible Notes including the fair value of the

conversion feature, which was reduced by the discount of $1,271 and

debt related costs of $1,673 associated with those Convertible Notes,

and the fair value of the common stock issued at the time of conversion.

Conversion of Convertible Notes in 2010. At the time of

conversions of the remaining $5,695 principal amount of Convertible

Notes (including $2,400 principal amount of Convertible Notes, which

were held by certain affiliates or associates of the Company's directors),

which converted into 19,638 shares of our common stock, we

determined that the aggregate fair value of the conversion feature of

those Convertible Notes was $32,358, which was an increase in value

of $7,308 from the fair value of the conversion feature as of December

31, 2009. This change in fair value was recorded as income within other

income (expense), net for the year ended December 31, 2010. The

aggregate fair value of the common stock issued by us in the conversion

was $35,404 at the time of conversion, which was recorded as common

stock and additional paid-in capital. In addition, in connection with the

extinguishment of the converted Convertible Notes, we recorded a loss

on extinguishment of $786 for the year ended December 31, 2010, which

represented the difference in the carrying value of those Convertible

Notes including and the fair value of the conversion feature, which was

reduced by the discount of $515 and debt related costs of $683 for the

year ended December 31, 2010, associated with those Convertible

Notes, and the fair value of the common stock issued at the time of

conversion and the payment made to note holders of $2,237 to induce

conversion.

VONAGE HOLDINGS CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)