Vonage 2012 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2012 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.F-20 VONAGE ANNUAL REPORT 2012

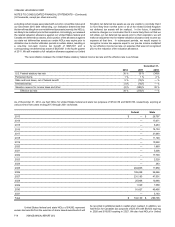

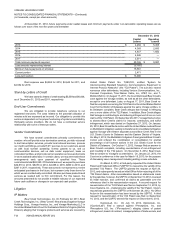

Kingdom tax purposes of $37,765 with no expiration date.

No provision has been made for income taxes on the

undistributed earnings of our foreign subsidiaries of $42,440 at

December 31, 2012 as we intend to indefinitely reinvest such earnings.

Under Section 382 of the Internal Revenue Code, if we

undergo an “ownership change” (generally defined as a greater than

50% change (by value) in our equity ownership over a three-year period),

our ability to use our pre-change of control NOLs and other pre-change

tax attributes against our post-change income may be limited. The

Section 382 limitation is applied annually so as to limit the use of our

pre-change NOLs to an amount that generally equals the value of our

stock immediately before the ownership change multiplied by a

designated federal long-term tax-exempt rate. At December 31, 2012,

there were no limitations on the use of our NOLs.

We participated in the State of New Jersey’s corporation

business tax benefit certificate transfer program, which allows certain

high technology and biotechnology companies to transfer unused New

Jersey net operating loss carryovers to other New Jersey corporation

business taxpayers. During 2003 and 2004, we submitted an application

to the New Jersey Economic Development Authority, or EDA, to

participate in the program and the application was approved. The EDA

then issued a certificate certifying our eligibility to participate in the

program. The program requires that a purchaser pay at least 75% of

the amount of the surrendered tax benefit. In tax years 2010, 2011, and

2012, we sold approximately, $2,194, $0, and $0, respectively, of our

New Jersey State net operating loss carry forwards for a recognized

benefit of approximately $168 in 2010, $0 in 2011, and $0 in 2012,

respectively. Collectively, all transactions represent approximately 85%

of the surrendered tax benefit each year and have been recognized in

the year received.

VONAGE HOLDINGS CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)