Vonage 2012 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2012 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37 VONAGE ANNUAL REPORT 2012

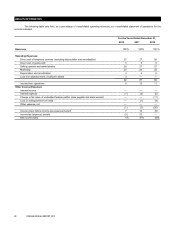

SUMMARY OF CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Our significant accounting policies are summarized in Note

1 to our consolidated financial statements. The following describes our

critical accounting policies and estimates:

Use of Estimates

Our consolidated financial statements are prepared in

conformity with accounting principles generally accepted in the United

States, which require management to make estimates and assumptions

that affect the amounts reported and disclosed in the consolidated

financial statements and the accompanying notes. Actual results could

differ materially from these estimates.

On an ongoing basis, we evaluate our estimates, including

the following:

> the useful lives of property and equipment, software

costs, and intangible assets;

> assumptions used for the purpose of determining

share-based compensation and the fair value of our

prior stock warrant using the Black-Scholes option

pricing model (“Model”), and various other

assumptions that we believed to be reasonable; the

key inputs for this Model are our stock price at

valuation date, exercise price, the dividend yield, risk-

free interest rate, life in years, and historical volatility

of our common stock;

> assumptions used in determining the need for, and

amount of, a valuation allowance on net deferred tax

assets;

> assumptions used to determine the fair value of the

embedded conversion option within our prior third lien

convertible notes using the Monte Carlo simulation

model; the key inputs are maturity date, risk-free

interest rate, our stock price at valuation date, and

historical volatility of our common stock; and

> assumptions used to determine the fair value of the

embedded make-whole premium feature within our

prior senior secured first lien credit facility and our

prior senior secured second lien credit facility.

We base our estimates on historical experience, available

market information, appropriate valuation methodologies, and on

various other assumptions that we believed to be reasonable, the results

of which form the basis for making judgments about the carrying values

of assets and liabilities.

Revenue Recognition

The point in time at which revenues are recognized is

determined in accordance with Staff Accounting Bulletin No. 104,

Revenue Recognition, and Financial Accounting Standards Board

(“FASB”) Accounting Standards Codification (“ASC”) 605, Revenue

Recognition.

At the time a customer signs up for our telephony services,

there are the following deliverables:

> Providing equipment, if any, to the customer that

enables our telephony services and

> Providing telephony services.

The equipment is provided free of charge to our customers

and in most instances there are no fees collected at sign-up. We record

the fees collected for shipping the equipment to the customer, if any, as

shipping and handling revenue at the time of shipment.

A further description of our revenues is as follows:

Substantially all of our operating revenues are telephony

services revenues, which are derived primarily from monthly

subscription fees that customers are charged under our service plans.

We also derive telephony services revenues from per minute fees for

international calls if not covered under a plan, including applications for

mobile devices and other stand-alone products, and for any calling

minutes in excess of a customer’s monthly plan limits. Monthly

subscription fees are automatically charged to customers’ credit cards,

debit cards or electronic check payments, or ECP, in advance and are

recognized over the following month when services are provided.

Revenues generated from international calls and from customers

exceeding allocated call minutes under limited minute plans are

recognized as services are provided, that is, as minutes are used, and

are billed to a customer’s credit cards, debit cards or ECP in arrears.

As a result of our multiple billing cycles each month, we estimate the

amount of revenues earned from international calls and from customers

exceeding allocated call minutes under limited minute plans but not

billed from the end of each billing cycle to the end of each reporting

period. These estimates are based primarily upon historical minutes and

have been consistent with our actual results.

We also provide rebates to customers who purchase their

customer equipment from retailers and satisfy minimum service period

requirements. These rebates in excess of activation fees are recorded

as a reduction of revenues over the service period based upon the

estimated number of customers that will ultimately earn and claim the

rebates.

Customer equipment and shipping revenues include sales to

our retailers, who subsequently resell this customer equipment to

customers. Revenues were reduced for payments to retailers and

rebates to customers, who purchased their customer equipment through

these retailers, to the extent of customer equipment and shipping

revenues.

Inventory

Inventory consists of the cost of customer equipment and is

stated at the lower of cost or market, with cost determined using the

average cost method. We provide an inventory allowance for customer

equipment that has been returned by customers but may not be able to

be reissued to new customers or returned to the manufacturer for credit.

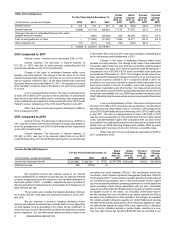

Income Taxes

We recognize deferred tax assets and liabilities at enacted

income tax rates for the temporary differences between the financial

reporting bases and the tax bases of our assets and liabilities. Any effects

of changes in income tax rates or tax laws are included in the provision

for income taxes in the period of enactment. Our net deferred tax assets

primarily consist of net operating loss carry forwards (“NOLs”). We are

required to record a valuation allowance against our net deferred tax

assets if we conclude that it is more likely than not that taxable income

generated in the future will be insufficient to utilize the future income tax

benefit from our net deferred tax assets (namely, the NOLs) prior to

expiration. We periodically review this conclusion, which requires

significant management judgment. If we are able to conclude in a future

period that a future income tax benefit from our net deferred tax assets

has a greater than 50 percent likelihood of being realized, we are

required in that period to reduce the related valuation allowance with a

corresponding decrease in income tax expense. This will result in a non-

cash benefit to our net income in the period of the determination. In the

future, if available evidence changes our conclusion that it is more likely

than not that we will utilize our net deferred tax assets prior to their

expiration, we will make an adjustment to the related valuation allowance

and income tax expense at that time. In the fourth quarter of 2011, we

released $325,601 of valuation allowance (see Note 5. Income Taxes).

In subsequent periods, we would expect to recognize income tax

expense equal to our pre-tax income multiplied by our effective income

tax rate, an expense that was not recognized prior to the reduction of

the valuation allowance.