Vonage 2012 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2012 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Since the Company’s inception, Vonage has harnessed the power

of the Internet to provide consumers with increased freedom

and exibility to communicate anywhere in the world. We’ve

eliminated the geographic boundaries associated with traditional

phone service, pioneered innovative new features and delivered

exceptional value to bring people closer together.

Now, in a world that has embraced mobility, we are innovating to

meet the communications needs of our customers once again.

And while the opportunity ahead of us is vast, our vision is clear:

to be a leading provider of communications services connecting

individuals through cloud-enabled broadband devices worldwide.

In 2012, our efforts brought us closer to realizing this vision. We

generated solid nancial and operating results and achieved

key milestones in each of our three strategic growth initiatives.

Our strong performance is the result of the hard work and

dedication of our nearly 1,000 employees around the world. While

we have more work to do, I’m pleased with the substantial

progress that we’ve made.

Our Transformation

Over the past ve years, we have fundamentally transformed

our strategy, our operations and our nancial performance. These

changes have resulted in an increase of $182million in adjusted

EBITDA* and $214million in Free Cash Flow.*

Strategically, we shifted our primary focus to the rapidly growing

but underserved ethnic segments in the U.S. We improved

our value proposition by being the rst to deliver at-rate unlimited

calling to more than 60 countries with the launch of our Vonage

World service. And, we were the rst to provide easy-to-use

enhanced features like voice-to-text translation and mobile

extension services at no extra cost. These strategic shifts have

resulted in new customers with a higher lifetime value and a

better churn pro le than those in the past.

Our focus on operations has resulted in a greatly improved cost

structure. Since 2008, we reduced network and domestic termination

costs by 63%; and, international long distance termination rates

are down 30%. In addition, we’ve reduced customer care costs

per line by 45%, resulting in $50million in annual savings. Perhaps

more importantly, we’ve been able to execute these structural

cost enhancements while signi cantly improving our call quality

and customer service performance.

We have also transformed our balance sheet. Two debt re nanc-

ings reduced annual interest expense from $49million in 2010

to less than $6million in 2012, and reduced interest rates from 20%

in 2009 to less than 4% today. Capitalizing on the low interest

rate environment and our strong nancials, we completed a third

re nancing in February 2013, providing us with additional liquidity

and enhanced exibility to invest in growth, while further reducing

our cost of borrowing.

In August 2012, as part of our balanced approach to capital

allocation, we initiated a $50million stock repurchase program.

By early 2013, we had repurchased 14million shares of common

stock. Re ecting our continued belief that buybacks can be

an effective use of capital to create shareholder value, our Board

of Directors authorized a new $100million share repurchase pro-

gram to be concluded by the end of 2014. The nancial markets

have responded positively. Since announcing our initial repurchase

plan, Vonage stock has appreciated by 60%.

Having achieved nancial and operational stability, our teams have

also rekindled the spirit of innovation that is our heritage. In 2012,

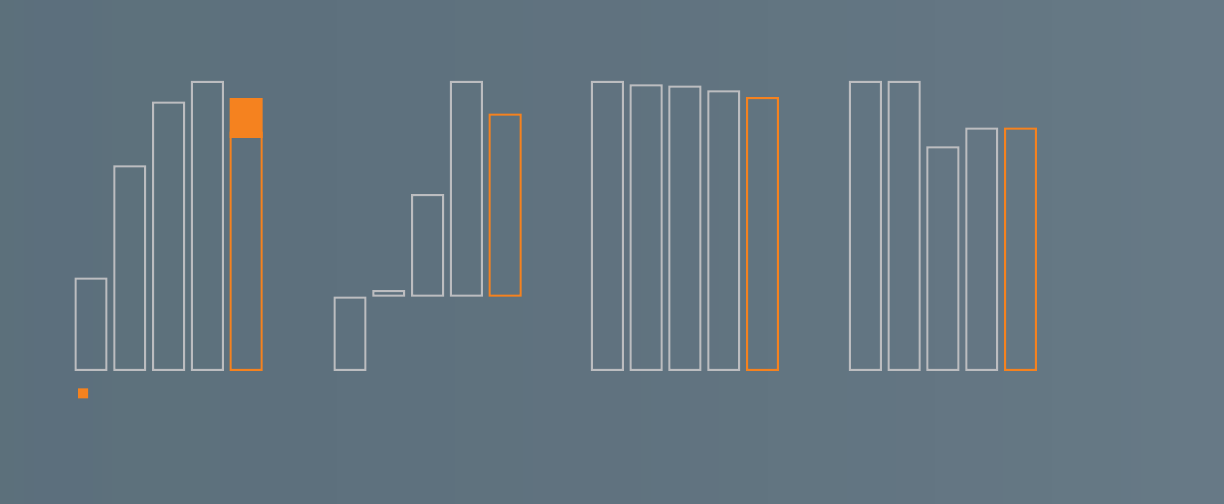

2.6%

3.1% 3.1%

2.4%

2.6%

Average Monthly

Customer Churn

Revenue

(IN MILLIONS)

$849

08

$900

09

$889

10

$885

11

$870

12

08

09

10 11 12

08 09 10 11 12

($34)

$3

$47

$99

$84

Net Income (Loss),

Ex-Adjustments*

(IN MILLIONS)

08 09 10 11 12

$54

$119

$156

$168

$135

$23

Adjusted EBITDA*

(IN MILLIONS)

Investment in growth initiatives

*Adjusted EBITDA, net income (loss) excluding adjustments and Free Cash Flow are non-GAAP nancial measures. We dene adjusted EBITDA as GAAP (loss) income from operations excluding depreciation and amortization,

loss from abandonment of software assets, and share-based expense. We dene net income (loss) excluding adjustments as GAAP net income (loss) excluding loss from abandonment of software assets, the change in fair value

of embedded features within notes payable and stock warrant, the loss (gain) on extinguishment of notes and income tax expense (benet). Vonage denes Free Cash Flow as net cash provided by operating activities minus

capital expenditures, intangible assets and acquisition and development of software assets.

Dear Shareholders,