Vodafone 2016 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Operating results

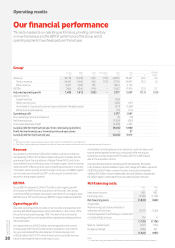

Our nancial performance

This section presents our operating performance, providing commentary

on how the revenue and the EBITDA performance of the Group and its

operating segments have developed over the last year.

Group1

Europe

£m

AMAP

£m

Other2

£m

Eliminations

£m

2016

£m

2015

£m

% change

£Organic

Revenue 26,718 13, 208 1,16 0 (113) 40,973 42,227 (3.0) 2.3

Service revenue 24,461 11, 8 43 968 (113 ) 3 7,159 38,497 (3.5) 1.5

Other revenue 2,257 1,365 192 –3,814 3,730

EBITDA 7, 6 86 4,042 (116 ) –11, 612 11, 915 (2.5) 2.7

Adjusted operating prot 1,409 1,813 (105) –3 ,117 3,507 (11.1) (3.9)

Adjustments for:

Impairment loss (450) –

Restructuring costs (236) (157)

Amortisation of acquired customer bases and brand intangible assets (979) (1,269)

Other income and expense (75) (114 )

Operating prot 1,377 1,967

Non-operating income and expense (2) (19)

Net nancing costs (1,824) (853)

Income tax (expense)/credit (3,369) 4,765

(Loss)/prot for the nancial year from continuing operations (3,818) 5,860

Prot for the nancial year from discontinued operations – 57

(Loss)/prot for the nancial year (3,818) 5,917

Notes:

1 2016 results reect average foreign exchange rates of £1:€1.37, £1:INR 98.61 and £1:ZAR 20.72.

2 The “Other” segment primarily represent the results of the partner markets and the net result of unallocated central Group costs.

Revenue

Group revenue decreased 3.0% to £41.0 billion and service revenue

decreased by 3.5% to £37.2 billion. Reported growth includes the full

year impact from the acquisitions of Hellas Online (‘HOL’) and Cobra

Automotive (‘Cobra’) in the prior year. In Europe, organic service revenue

declined 0.6%* reecting continued competitive pressures in a number

of markets, with improving trends throughout the year. In AMAP, organic

service revenue increased by 6.9%* continuing its sustained track

record of strong organic growth.

EBITDA

Group EBITDA declined 2.5% to £11.6 billion, with organic growth

in Europe and AMAP and the acquisitions of HOL and Cobra being

more than offset by foreign exchange movements. On an organic basis,

EBITDA rose 2.7%* and the Group’s EBITDA margin stabilised at 28.3%.

Operating prot

Adjusted operating prot excludes certain income and expenses that

we have identied separately to allow their effect on the results of the

Group to be assessed (see page 190). The items that are included

in operating prot but are excluded from adjusted operating prot are

discussed below.

An impairment loss of £450 million was recognised in the current

nancial year (2015: £nil). Further detail is provided in note 4 to the

Group’s consolidated nancial statements. Restructuring costs

of £236 million (2015: £157 million) have been incurred to improve

future business performance and reduce costs.

Amortisation of intangible assets in relation to customer bases and

brands are recognised under accounting rules after we acquire

businesses and decreased to £979 million (2015: £1,269 million)

due to the acquisition of Ono.

Including the above items, operating profit decreased by £0.6 billion

to £1.4 billion as the £0.45 billion impairment charge, £0.3 billion reduction

in EBITDA and £0.1 billion increase in restructuring costs were partly

offset by £0.1 billion of lower depreciation and amortisation charges and

£0.1 billion higher contribution from associates and joint ventures.

Net nancing costs

2016

£m

2015

£m

Investment income 300 883

Financing costs (2,124) (1.736)

Net nancing costs (1,824) (853)

Analysed as:

Net nancing costs before interest on

settlement of tax issues (1,107) (1,160)

Interest (expense)/credit arising on settlement

of outstanding tax issues (15) 4

(1,122) (1,156)

Mark-to-market losses (247) (134)

Foreign exchange1(455) 437

(1,824) (853)

Note:

1 Comprises foreign exchange rate differences in relation to certain intercompany balances.

Vodafone Group Plc

Annual Report 2016

30