Vodafone 2016 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc

Annual Report 2016

128

Notes to the consolidated nancial statements (continued)

21. Borrowings (continued)

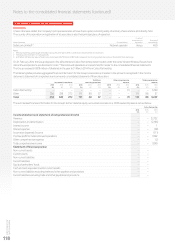

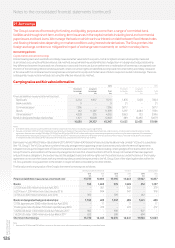

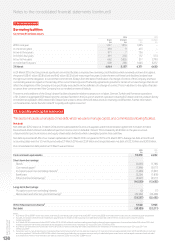

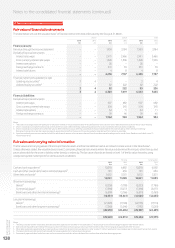

Maturity of borrowings and other nancial liabilities

The maturity prole of the anticipated future cash ows including interest in relation to the Group’s non-derivative nancial liabilities on an

undiscounted basis which, therefore, differs from both the carrying value and fair value, is as follows:

Loans in

Bank Commercial Other designated hedge

loans paper Bonds liabilities relationships Total

£m £m £m £m £m £m

Within one year 2,444 7,4 0 5 703 4,338 1,304 16,194

In one to two years 1,257 – 889 57 2,787 4,990

In two to three years 1,599 – 2,681 43 686 5,009

In three to four years 1,297 – 180 14 1,175 2,666

In four to ve years 1,106 – 2,798 15 630 4,549

In more than ve years 4,716 – 5,816 141 9,741 20,414

12,419 7, 4 0 5 13,067 4,608 16,323 53,822

Effect of discount/nancing rates (3,208) (9) (1,368) (36) (3,854) (8,475)

31 March 2016 9,211 7, 3 96 11,699 4,572 12,469 45,347

Within one year 1,928 5,092 1,588 3,885 873 13,366

In one to two years 831 – 610 18 1,256 2,715

In two to three years 1,090 – 831 11 2,650 4,582

In three to four years 920 – 1,191 12 626 2,749

In four to ve years 862 – 135 12 1,101 2,110

In more than ve years 1,660 – 4,958 115 8,118 14,851

7, 2 91 5,092 9,313 4,053 14,624 40,373

Effect of discount/nancing rates (287) (15) (1,332) (36) (3,645) (5,315)

31 March 2015 7, 0 0 4 5,077 7, 98 1 4,017 10,979 35,058

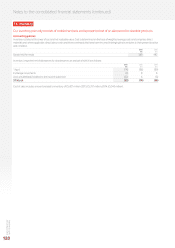

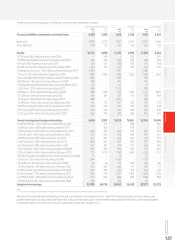

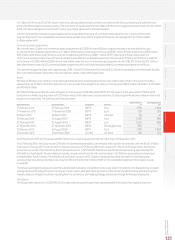

The maturity prole of the Group’s nancial derivatives (which include interest rate swaps, cross currency interest rate swaps and foreign exchange

swaps) using undiscounted cash ows, is as follows:

2016 2015

Payable Receivable Payable Receivable

£m £m £m £m

Within one year 25,990 26,912 2,647 3,537

In one to two years 8,429 8,632 5,457 4,005

In two to three years 3,807 4,147 4,179 4,617

In three to four years 2,088 2,363 1,430 1,942

In four to ve years 1,913 2,050 1,145 2,164

In more than ve years 18,851 20,897 13,177 17,864

61,078 65,001 28,035 34,129

Payables and receivables are stated separately in the table above as settlement is on a gross basis. The net effect of discount/nancing rates

is £1,183 million (2015: £3,073 million), leaving a £2,740 million (2015: £3,021 million) net receivable in relation to nancial instruments. This is split

£1,564 million (2015: £984 million) within trade and other payables and £4,304 million (2015: £4,005 million) within trade and other receivables.

Gains and losses recognised in the hedging reserve in equity on cross currency interest rate swaps as at 31 March 2016 will be continuously released

to the income statement within nancing costs until the repayment of certain bonds classied as loans designated in hedge relationships in the

table of maturities of non-derivative nancial liabilities above.

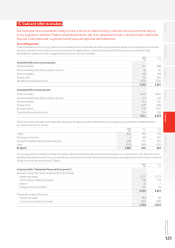

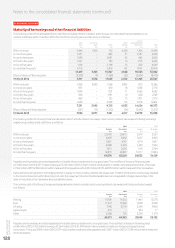

The currency split of the Group’s foreign exchange derivatives (which includes cross currency interest rate swaps and foreign exchange swaps)

is as follows:

2016 2015

Payable Receivable Payable Receivable

£m £m £m £m

Sterling 17, 8 9 0 14, 253 11 ,4 61 12,578

Euro 11, 67 2 19,369 8,158 6,228

US dollar 7, 74 8 10 ,178 5,598 9,908

Japanese yen 673 – 594 17

Other 5,388 795 3,238 1,374

43,371 44,595 29,049 30 ,10 5

Payables and receivables are stated separately in the table above as settlement is on a gross basis. The net effect of discount/nancing rates

is £40 million (2015: £192 million), leaving a £1,264 million (2015: £1,248 million) net receivable in relation to foreign exchange nancial

instruments. This is split £593 million (2015: £291 million) within trade and other payables and £1,857 million (2015: £1,539 million) within trade and

other receivables.