Vodafone 2016 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview Strategy review Performance Governance Financials Additional information

Vodafone Group Plc

Annual Report 2016

169

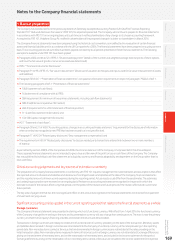

Notes to the Company nancial statements

1. Basis of preparation

The Company has transitioned from the previously extant UK Generally Accepted Accounting Practice (UK GAAP) to Financial Reporting

Standard 101 “Reduced disclosure framework”, (FRS 101), for all periods presented. The Company will continue to prepare its nancial statements

in accordance with FRS 101 on an ongoing basis until such time as it noties shareholders of any change to its chosen accounting framework.

As required by FRS 101, Vodafone Group Plc notied its shareholders of the proposed change in its letter to shareholders in March 2016.

The Company nancial statements have been prepared using the historical cost convention, as modied by the revaluation of certain nancial

assets and nancial liabilities and in accordance with the UK Companies Act 2006. The nancial statements have been prepared on a going concern

basis. The accounting policies set out below have been applied consistently to all periods presented in these nancial statements. The following

exemptions available under FRS 101 have been applied:

a Paragraphs 45(b) and 46 to 52 of IFRS 2, “Shared-based payment” (details of the number and weighted-average exercise prices of share options,

and how the fair value of goods or services received was determined);

a IFRS 7 “Financial Instruments: Disclosures”;

a Paragraph 91 to 99 of IFRS 13, “Fair value measurement” (disclosure of valuation techniques and inputs used for fair value measurement of assets

and liabilities);

a Paragraph 38 of IAS 1 “Presentation of nancial statements” comparative information requirements in respect of paragraph 79(a)(iv) of IAS 1;

a The following paragraphs of IAS 1 “Presentation of nancial statements”:

a 10(d) (statement of cash ows);

a 16 (statement of compliance with all IFRS);

a 38A (requirement for minimum of two primary statements, including cash ow statements);

a 38B-D (additional comparative information);

a 40A-D (requirements for a third statement of nancial position);

a 111 (cash ow statement information); and

a 134-136 (capital management disclosures).

a IAS 7 “Statement of cash ows”;

a Paragraph 30 and 31 of IAS 8 “Accounting policies, changes in accounting estimates and errors” (requirement for the disclosure of information

when an entity has not applied a new IFRS that has been issued but is not yet effective);

a Paragraph 17 of IAS 24 “Related party disclosures” (key management compensation); and

a The requirements in IAS 24 “Related party disclosures” to disclose related party transactions entered into between two or more members

of a group.

As permitted by section 408(3) of the Companies Act 2006, the income statement of the Company is not presented in this Annual Report.

Theseseparate nancial statements are not intended to give a true and fair view of the prot or loss or cash ows of the Company. The Company

hasnot published its individual cash ow statement as its liquidity, solvency and nancial adaptability are dependent on the Group rather than its

own cash ows.

Critical accounting judgements and key sources of estimation uncertainty

The preparation of Company nancial statements in conformity with FRS 101 requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the Company nancial statements

and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates. The estimates

and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognised in the period in which the

estimate is revised if the revision affects only that period or in the period of the revision and future periods if the revision affects both current and

future periods.

The key area of judgement that has the most signicant effect on the amounts recognised in the nancial statements is the review for impairment

of investment carrying values.

Signicant accounting policies applied in the current reporting period that relate to the nancial statements as a whole

Foreign currencies

The Company’s nancial statements are presented in sterling, which is its functional currency. With effect from 1 April 2016 the functional currency

of the Company changed from sterling to the euro and its presentation currency will also change from sterling to euro. The euro is now the primary

currency in which the Company’s nancing activities and investment returns are denominated.

Transactions in foreign currencies are initially recorded at the functional rate of currency prevailing on the date of the transaction. Monetary assets

and liabilities denominated in foreign currencies are retranslated into the Company’s functional currency at the rates prevailing on the reporting

period date. Non-monetary items carried at fair value that are denominated in foreign currencies are retranslated at the rates prevailing on the

initial transaction dates. Non-monetary items measured in terms of historical cost in a foreign currency are not retranslated. Exchange differences

arising on the settlement of monetary items, and on the retranslation of monetary items, are included in the income statement for the period.

Exchange differences arising on the retranslation of non-monetary items carried at fair value are included in the income statement for the period.