Vodafone 2016 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc

Annual Report 2016

136

Notes to the consolidated nancial statements (continued)

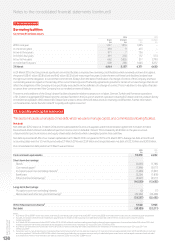

23. Capital and nancial risk management (continued)

The Group invested in UK index linked government bonds on the basis that they generated a oating rate return in excess of £ LIBOR and are

amongst the most creditworthy of investments available.

The Group has two managed investment funds. These funds hold xed income sterling securities and the average credit quality is high double A.

Money market investments are in accordance with established internal treasury policies which dictate that an investment’s long-term credit rating

is no lower than mid BBB. Additionally, the Group invests in AAA unsecured money market mutual funds where the investment is limited to 10%

of each fund.

The Group has investments in repurchase agreements which are fully collateralised investments. The collateral is sovereign and supranational

debt with at least one AAA rating denominated in euros, sterling and US dollars and can be readily converted to cash. In the event of any default,

ownership of the collateral would revert to the Group. Detailed below is the value of the collateral held by the Group at 31 March:

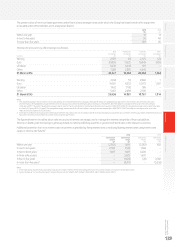

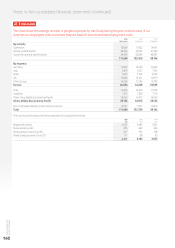

2016 2015

£m £m

Sovereign 2,700 1,977

Supranational –23

2,700 2,000

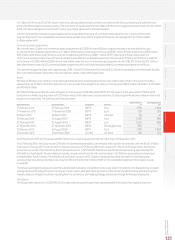

In respect of nancial instruments used by the Group’s treasury function, the aggregate credit risk the Group may have with one counterparty

is limited by (i)reference to the long-term credit ratings assigned for that counterparty by Moody’s, Fitch Ratings and Standard & Poor’s; (ii)that

counterparty’s ve year credit default swap (‘CDS’) spread; and (iii)the sovereign credit rating of that counterparty’s principal operating jurisdiction.

Furthermore, collateral support agreements were introduced from the fourth quarter of 2008. Under collateral support agreements the

Group’s exposure to a counterparty with whom a collateral support agreement is in place is reduced to the extent that the counterparty must post

cash collateral when there is value due to the Group under outstanding derivative contracts that exceeds a contractually agreed threshold amount.

When value is due to the counterparty the Group is required to post collateral on identical terms. Such cash collateral is adjusted daily as necessary.

In the event of any default, ownership of the cash collateral would revert to the respective holder at that point. Detailed below is the value of the cash

collateral, which is reported within short-term borrowings, held by the Group at 31 March:

2016 2015

£m £m

Cash collateral 2,837 2,542

The majority of the Group’s trade receivables are due for maturity within 90 days and largely comprise amounts receivable from consumers and

business customers. At 31 March 2016 £3,227 million (2015: £2,869 million) of trade receivables were not yet due for payment. Overduetrade

receivables consisted of £1,293 million (2015: £1,141 million) relating to the Europe region, and £252 million (2015: £222 million) relating to the

AMAP region. Financial statements are monitored by management and provisions for bad and doubtful debts raised where it is deemed appropriate.

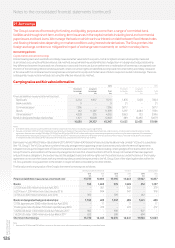

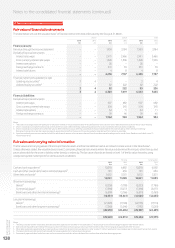

The following table presents ageing of receivables that are past due and provisions for doubtful receivables that have been established:

2016 2015

Gross

receivables

Less

provisions

Net

receivables

Gross

receivables

Less

provisions

Net

receivables

£m £m £m £m £m £m

30 days or less 727 (272) 455 417 (61) 356

Between 31 and 60 days 261 (69) 192 231 (35) 196

Between 61 and 180 days 394 (89) 305 288 (67) 221

Greater than 180 days 1,108 (515) 593 1,205 (615) 590

2,490 (945) 1,545 2,141 (778) 1,363

Concentrations of credit risk with respect to trade receivables are limited given that the Group’s customer base is large and unrelated. Due to this,

management believes there is no further credit risk provision required in excess of the normal provision for bad and doubtful receivables.

Amounts charged to administrative expenses duringthe year ended 31 March 2016 were £498 million (2015: £541 million; 2014: £347 million)

(seenote 15 “Trade and other receivables”).

As discussed in note 30 “Contingent liabilities and legal proceedings”, the Group has covenanted to provide security in favour of the trustee of the

Vodafone Group UK Pension Scheme in respect of the funding decit in the scheme. The security takes the form of an English law pledge over

UK index linked government bonds.