Vodafone 2016 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2016 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview Strategy review Performance Governance Financials Additional information

Vodafone Group Plc

Annual Report 2016

137

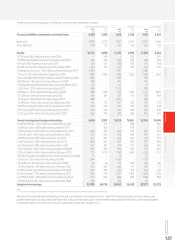

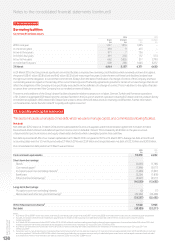

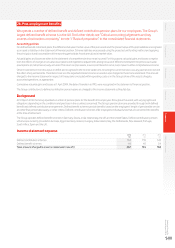

Liquidity risk

At 31 March 2016 the Group had €4.0 billion and US$4.1 billion syndicated committed undrawn bank facilities which support the US$15 billion and

£8 billion commercial paper programme available to the Group. The Group uses commercial paper and bank facilities to manage short-term liquidity

and manages long-term liquidity by raising funds in the capital markets.

The euro syndicated committed facility has a maturity date of 28 March 2021. From 28 March 2020 the facility will be downsized to €3.9 billion

as one lender did not exercise the option to extend the facility for a further year as requested by the Company. The US$ syndicated committed

facility has a maturity date of 27 February 2021 with each lender having the option to extend the facility for a further year prior to the second

anniversary of the facility, if requested by the Company. From 27 February 2020 the facility will be downsized to US$3.9 billion as one lender did

not exercise the option to extend the facility for a further year as requested by the Company. Both facilities have remained undrawn throughout

thenancial year and since year end and provide liquidity support.

The Group manages liquidity risk on long-term borrowings by maintaining a varied maturity prole with a cap on the level of debt maturity in any

one calendar year, therefore minimising renancing risk. Long-term borrowings mature between one and 29 years.

Liquidity is reviewed daily on at least a 12 month rolling basis and stress tested on the assumption that all commercial paper outstanding

matures and is not reissued. The Group maintains substantial cash and cash equivalents which at 31 March 2016 amounted to £10,218 million

(2015: £6,882 million).

Market risk

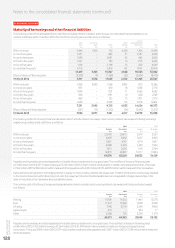

Interest rate management

Under the Group’s interest rate management policy, interest rates on monetary assets and liabilities denominated in euros, US dollars and sterling

are maintained on a oating rate basis except for periods up to six years where interest rate xing has to be undertaken in accordance with treasury

policy. Where assets and liabilities are denominated in other currencies interest rates may also be xed. In addition, xing is undertaken for longer

periods when interest rates are statistically low.

For each one hundred basis point fall or rise in market interest rates for all currencies in which the Group had borrowings at 31 March 2016 there

would be an increase or decrease in prot before tax by approximately £23 million (2015: increase or decrease by £36 million) including mark-to-

market revaluations of interest rate and other derivatives and the potential interest on outstanding tax issues. There would be no material impact

on equity.

Foreign exchange management

As Vodafone’s primary listing is on the London Stock Exchange its share price is quoted in sterling. Since the sterling share price represents the value

of its future multi-currency cash ows, principally in euro, South African rand, Indian rupee and sterling, the Group maintains the currency of debt

and interest charges in proportion to its expected future principal multi-currency cash ows and has a policy to hedge external foreign exchange

risks on transactions denominated in other currencies above certain de minimis levels.

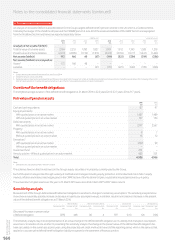

At 31 March 2016, 109% of net debt was denominated in currencies other than sterling (59% euro, 26% India rupee, 10% US dollar and 14% other)

while 9% of net debt had been purchased forward in sterling in anticipation of sterling denominated shareholder returns via dividends. This allows

euro, US dollar and other debt to be serviced in proportion to expected future cash ows and therefore provides a partial hedge against income

statement translation exposure, as interest costs will be denominated in foreign currencies.

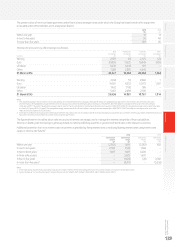

Under the Group’s foreign exchange management policy, foreign exchange transaction exposure in Group companies is generally maintained at the

lower of €5 million per currency per month or €15 million per currency over a six month period.

The Group recognises foreign exchange movements in equity for the translation of net investment hedging instruments and balances treated

as investments in foreign operations. However, there is no net impact on equity for exchange rate movements on net investment hedging

instruments as there would be an offset in the currency translation of the foreign operation. At 31 March 2016 the Group held nancial liabilities

in a net investment against the Group’s consolidated euro net assets. Sensitivity to foreign exchange movements on the hedging liabilities, analysed

against a strengthening of the euro by 8% (2015: 5%) would result in a decrease in equity of £1,350 million (2015: £876 million) which would be fully

offset by foreign exchange movements on the hedged net assets.

The following table details the Group’s sensitivity of the Group’s adjusted operating prot to a strengthening of the Group’s major currency in which

it transacts. The percentage movement applied to the currency is based on the average movements in the previous three annual reporting periods.

Amounts are calculated by retranslating the operating prot of each entity whose functional currency is euro.

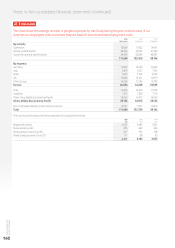

2016 2015

£m £m

Euro 8% (2015: 5%) change – Operating prot1109 81

Note:

1 Operating prot before impairment losses and other income and expense.

At 31 March 2016 the Group’s sensitivity to foreign exchange movements, analysed against a strengthening of the US dollar by 8% (2015: 9%) on its

external US dollar exposure, would decrease the prot before tax by £60 million (2015: £71 million). Foreign exchange on certain internal balances

analysed against a strengthening of the US dollar of 8% (2015: 9%) and euro of 8% (2015: 5%) would increase the prot before tax by £0.8 million

(2015:decrease prot by £65 million) and decrease prot before tax by £318 million (2015: £186 million) for US dollar and euro respectively.

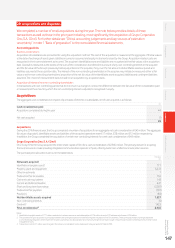

Equity risk

There is no material equity risk relating to the Group’s equity investments which are detailed in note 13 “Other investments”.

The Group has hedged its exposure under the subordinated mandatory convertible bonds to any future movements in its share price

by an option strategy designed to hedge the economic impact of share price movements during the term of the bonds. As at 31 March 2016 the

Group’s sensitivity to a movement of 5% in its share price would result in an increase or decrease in prot before tax of approximately £144 million.