United Healthcare 2001 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2001 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 50 UnitedHealth Group

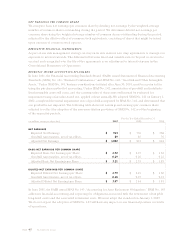

[7]COMMERCIAL PAPER AND DEBT

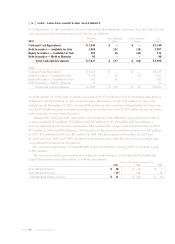

Commercial paper and debt consisted of the following as of December 31 (in millions):

2 0 0 1 2000

Carrying Fair Carrying Fair

Value Value Value Value

Commercial Paper $ 684 $ 684 $409 $409

Floating-Rate Notes

due November 2001 –– 150 150

Floating-Rate Notes

due November 2003 100 100 – –

Floating-Rate Notes

due November 2004 150 150 – –

6.6% Senior Unsecured Notes

due December 2003 250 266 250 250

7.5% Senior Unsecured Notes

due November 2005 400 433 400 413

Total Commercial Paper and Debt 1,584 1,633 1,209 1,222

Less Current Maturities (684) (684) (559) (559)

Long-Term Debt, less current maturities $ 900 $ 949 $650 $663

As of December 31, 2001, our outstanding commercial paper had interest rates ranging from 1.9%

to 2.7%. In November 2001, we issued $100 million of floating-rate notes due November 2003 and

$150 million of floating-rate notes due November 2004. The interest rates on the notes are reset quarterly

to the three-month LIBOR (London Interbank Offered Rate) plus 0.3% for the notes due November 2003

and to the three-month LIBOR plus 0.6% for the notes due November 2004. As of December 31, 2001, the

applicable rates on the notes were 2.4% and 2.7%, respectively. A portion of the proceeds from these

borrowings was used to repay the $150 million of floating-rate notes that matured in November 2001.

In January 2002, we issued $400 million of 5.2% fixed-rate notes due January 2007. Proceeds from this

borrowing will be used to repay commercial paper and for general corporate purposes including working

capital, capital expenditures, business acquisitions and share repurchases. When we issued these notes,

we entered into interest rate swap agreements that qualify as fair value hedges to convert a portion of our

interest rate exposure from a fixed to a variable rate. The interest rate swap agreements have an

aggregate notional amount of $200 million maturing January 2007. The variable rates approximate the

six-month LIBOR and are reset on a semiannual basis.

We have credit arrangements for $900 million that support our commercial paper program. These

credit arrangements include a $450 million revolving facility that expires in July 2005, and a $450 million,

364-day facility that expires in July 2002. We also have the capacity to issue approximately $200 million

of extendible commercial notes (ECNs). As of December 31, 2001 and 2000, we had no amounts

outstanding under our credit facilities or ECNs.

Our debt agreements and credit facilities contain various covenants, the most restrictive of which

require us to maintain a debt-to-total-capital ratio below 45% and to exceed specified minimum interest

coverage levels. We are in compliance with the requirements of all debt covenants.

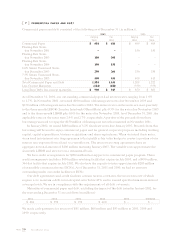

Maturities of commercial paper and debt, excluding the impact of the debt issued in January 2002, for

the years ending December 31 are as follows (in millions):

2002 2003 2004 2005 2006 Thereafter

$684 $350 $150 $400 $–$–

We made cash payments for interest of $91 million, $68 million and $43 million in 2001, 2000 and

1999, respectively.