United Healthcare 2001 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2001 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 48 UnitedHealth Group

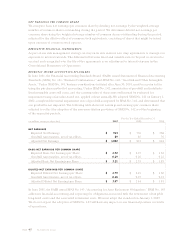

[5]AARP

In January 1998, we began providing services under a 10-year contract to provide insurance products and

services to members of AARP. Under the terms of the contract, we are compensated for claim adminis-

tration and other services as well as for assuming underwriting risk. We are also engaged in product devel-

opment activities to complement the insurance offerings under this program. Premium revenues from our

portion of the AARP insurance offerings were approximately $3.5 billion during 2001, 2000 and 1999.

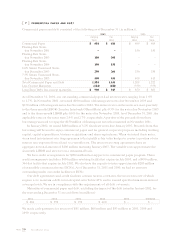

The underwriting gains or losses related to the AARP business are recorded as an increase or decrease to

a rate stabilization fund (RSF). The primary components of the underwriting results are premium revenue,

medical costs, investment income, administrative expenses, member service expenses, marketing expenses

and premium taxes. Underwriting gains and losses are charged to the RSF and accrue to AARP policyholders,

unless cumulative net losses were to exceed the balance in the RSF. To the extent underwriting losses exceed

the balance in the RSF, we would have to fund the deficit. Any deficit we fund could be recovered by under-

writing gains in future periods of the contract. The RSF balance is reported in Other Policy Liabilities in the

accompanying Consolidated Balance Sheets. We believe the RSF balance is sufficient to cover potential future

underwriting or other risks associated with the contract.

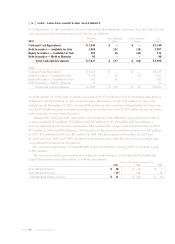

When we entered the contract, we assumed the policy and other policy liabilities related to the AARP

program, and we received cash and premium receivables from the previous insurance carrier equal to the

carrying value of these liabilities as of January 1, 1998. The following AARP program-related assets and

liabilities are included in our Consolidated Balance Sheets (in millions):

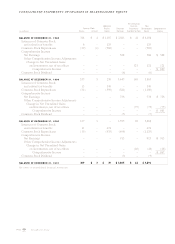

Balance as of December 31,

2 0 0 1 2000

Assets Under Management $ 1,882 $1,625

Accounts Receivable $ 281 $277

Medical Costs Payable $ 867 $855

Other Policy Liabilities $ 1,180 $932

Accounts Payable and Accrued Liabilities $ 116 $115

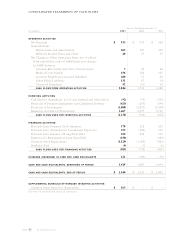

The effects of changes in balance sheet amounts associated with the AARP program accrue to AARP

policyholders through the RSF balance. Accordingly, we do not include the effect of such changes in

our Consolidated Statements of Cash Flows.