United Healthcare 2001 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2001 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 46 UnitedHealth Group

In August 2001, the FASB issued SFAS No. 144, “Accounting for Impairment or Disposal of Long-Lived

Assets,” which provides new accounting and financial reporting guidance for the impairment or disposal

of long-lived assets and the disposal of segments of a business. We adopted the standard on January 1,

2002, and its adoption did not have any impact on our financial position or results of operations.

RECLASSIFICATIONS

Certain 1999 and 2000 amounts in the consolidated financial statements have been reclassified to

conform to the 2001 presentation. These reclassifications have no effect on net earnings or share-

holders’ equity as previously reported.

[3]ACQUISI TIONS

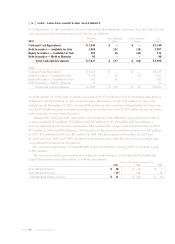

In October 2001, our Specialized Care Services business segment acquired Spectera, Inc. (Spectera), a leading

vision care benefit company in the United States, to expand the breadth of service offerings we extend to

our customers. We paid $37 million in cash, accrued $25 million for additional consideration due, and

issued 1.2 million shares of common stock with a value of $81 million in exchange for all outstanding shares of

Spectera. The purchase price and related acquisition costs of approximately $146 million exceeded the

preliminary estimated fair value of net assets acquired by $126 million. Under the purchase method of

accounting, we assigned this amount to goodwill. The results of Spectera’s operations since the acquisition

date are included in our 2001 Consolidated Statement of Operations. The pro forma effects of the Spectera

acquisition on our consolidated financial statements were not material. In February 2002, the $25 million of

accrued consideration was satisfied by issuing an additional 335,000 shares of our common stock.

In September 1999, our Ingenix business segment acquired Worldwide Clinical Trials, Inc. (WCT),

a leading clinical research organization. We paid $214 million in cash in exchange for all outstanding

shares of WCT, and we accounted for the purchase using the purchase method of accounting. Only the

post-acquisition results of WCT are included in our consolidated financial statements. The purchase

price and other acquisition costs exceeded the estimated fair value of net assets acquired by $214 million,

which was assigned to goodwill and is being amortized over its estimated useful life of 30 years. The pro

forma effects of the WCT acquisition on our consolidated financial statements were not material.

In June 1999, our Specialized Care Services business segment acquired Dental Benefit Providers, Inc.

(DBP), one of the largest dental benefit management companies in the United States. We paid $105 million

in cash, and we accounted for the acquisition using the purchase method of accounting. The purchase

price and other acquisition costs exceeded the estimated fair value of net assets acquired by $105 million,

which was assigned to goodwill and is being amortized over its estimated useful life of 40 years. The pro

forma effects of the DBP acquisition on our consolidated financial statements were not material.

For the years ended December 31, 2001, 2000 and 1999, consideration paid or issued for smaller

acquisitions accounted for under the purchase method, which were not material to our consolidated

financial statements, was $134 million, $76 million and $15 million, respectively.