TomTom 2005 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2005 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

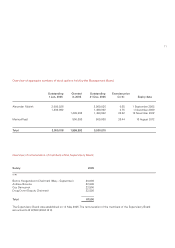

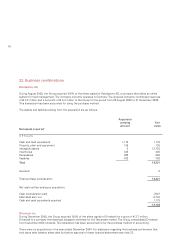

18.Shareoptions

TheCompanyadoptedashareoptionplanasanincentiveformembersofmanagementandeligibleemployees.

Underthescheme,theSupervisoryBoardmaygrantoptionstomembersofmanagementtosubscribeforshares.

TheManagementBoardmaygrantoptionstoeligibleemployeestosubscribeforshares.Thepurposeoftheshareoption

planistoaligntheinterestsofmanagementandeligibleemployeeswiththoseofshareholdersbyprovidingadditional

incentivestoimprovetheCompany’sperformanceonalongtermbasis.

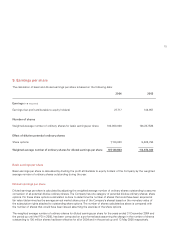

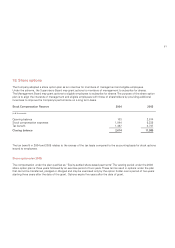

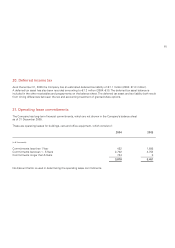

StockCompensationReserve 2004 2005

(in

thousands)

Openingbalance 103 2,614

Stockcompensationexpenses 1,044 5,238

Taxbenefit 1,467 3,737

Closingbalance 2,614 11,589

Thetaxbenefitin2004and2005relatestotheexcessofthetaxbasiscomparedtotheaccountingbasisforstockoptions

issuedtoemployees.

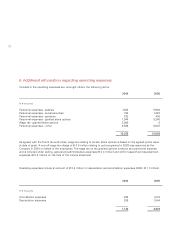

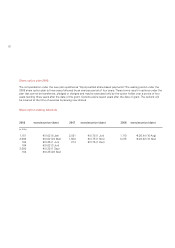

Shareoptionplan2003:

Thecompensationundertheplanqualifiesas“Equity-settledshare-basedpayments”.Thevestingperiodunderthe2003

shareoptionplanisthreeyearsfollowedbyanexerciseperiodoftwoyears.Thesetermsresultinoptionsundertheplan

thatcannotbetransferred,pledgedorchargedandmaybeexercisedonlybytheoptionholderoveraperiodoftwoyears

startingthreeyearsafterthedateofthegrant.Optionsexpirefiveyearsafterthedateofgrant.