TomTom 2005 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2005 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.64

Financialinstrumentsandhedgepolicy

TheGroup’sactivitiesexposeitprimarilytothefinancial

risksofchangesinforeignexchangerates.TheGroup

usesderivativefinancialinstruments(primarilyforeign

currencyforwardcontracts)tomitigateitsrisks

associatedwithforeigncurrencyfluctuationsrelatingto

certainfirmcommitmentsandforecastedtransactions.

Theuseoffinancialderivativesisgovernedbythe

Group’spoliciesapprovedbytheSupervisoryBoard,

whichprovidewrittenprinciplesontheuseoffinancial

derivativesconsistentwiththeGroup’sriskmanagement

strategy.TheGroupdoesnotusederivativefinancial

instrumentsforspeculativepurposes.Derivativefinancial

instrumentsareinitiallymeasuredatfairvalueonthe

contractdate,andaremarkedagaintofairvalueat

subsequentreportingdates.Changesinthefairvalueof

derivativefinancialinstrumentsarerecognisedinthe

profitandlossaccountastheyarise,sincehedge

accountingisnotappliedbytheGroup.

Retirementbenefitcosts

Paymentstodefinedcontributionretirementbenefit

plansarechargedasanexpenseastheyfalldue.

Paymentsmadetostate-managedretirementbenefit

schemesaredealtwithaspaymentstodefined

contributionplanswheretheGroup’sobligationsunder

theplansareequivalenttothosearisinginadefined

contributionretirementbenefitplan.

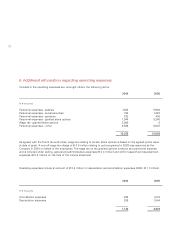

Stockcompensationexpense

TheGroupissuesshareoptions,whichqualifyas

equity-settledshare-basedpayments,toeligible

employeesincludingmembersofmanagement.

Equity-settledshare-basedpaymentsaremeasuredatfair

valueatthedateofgrant.Thefairvaluedeterminedat

thegrantdateoftheequity-settledshare-based

paymentsisexpensedonastraight-linebasisoverthe

vestingperiod,basedontheCompany’sestimateof

sharesthatwilleventuallyvest.Fairvalueismeasuredby

useoftheBlackandScholesmodel.Theexpectedlifeof

theshareoptionsusedinthemodelhasbeenadjusted,

basedonmanagement’sbestestimate,fortheeffectsof

non-transferability,exerciserestrictions,andbehavioural

considerations.Ateachbalancesheetdate,theentity

revisesitsestimatesofthenumberofoptionsthatare

expectedtobecomeexercisable.Itrecognisesthe

impactoftherevisionoforiginalestimates,ifany,inthe

incomestatement,andmakesacorresponding

adjustmenttoequity(stockcompensationreserve)over

theremainingvestingperiod.Theproceedsreceivednet

ofanydirectlyattributabletransactioncostsarecredited

tosharecapital(nominalvalue)andsharepremiumwhen

theoptionsareexercised.

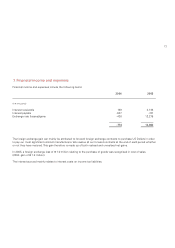

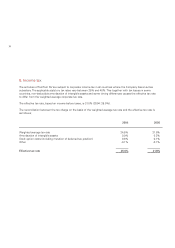

Taxation

Theincometaxchargeisbasedontheprofitfortheyear

andincludesdeferredtaxation.

Deferredtaxesarecalculatedusingtheliabilitymethod.

Deferredincometaxesreflectthenettaxeffectsof

temporarydifferencesbetweenthecarryingamountsof

assetsandliabilitiesforfinancialreportingpurposesand

theamountsusedforincometaxpurposes.Deferredtax

assetsandliabilitiesaremeasuredusingthetaxrates

expectedtoapplytotaxableincomeintheyearsinwhich

thosetemporarydifferencesareexpectedtobe

recoveredorsettled.Themeasurementofdeferredtax

liabilitiesanddeferredtaxassetsreflectsthetax

consequencesthatwouldfollowfromthemannerin

whichtheCompanyexpects,atthebalancesheetdate,

torecoverorsettlethecarryingamountofitsassets

andliabilities.

Deferredtaxassetsarerecognisedwhenitisprobable

thatsufficienttaxableprofitswillbeavailableagainst

whichthedeferredtaxassetscanbeutilised.Ateachbal-

ancesheetdate,theCompanyreassessesunrecognised

deferredtaxassetsandthecarryingamountofdeferred

taxassets.