TomTom 2005 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2005 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

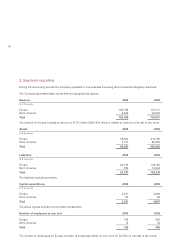

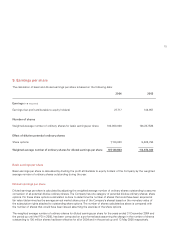

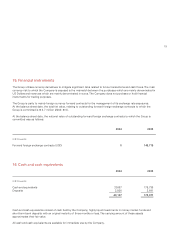

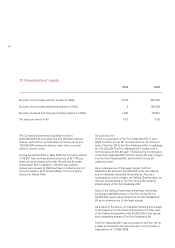

9.Earningspershare

Thecalculationofbasicanddilutedearningspershareisbasedonthefollowingdata:

2004 2005

Earnings

(in

thousands)

Earnings(netprofitattributabletoequityholders) 27,717 142,957

Numberofshares

Weightedaveragenumberofordinarysharesforbasicearningspershare 100,000,000 104,247,526

Effectofdilutivepotentialordinaryshares

Shareoptions 7,130,803 9,426,794

Weightedaveragenumberofordinarysharesfordilutedearningspershare

107,130,803 113,674,320

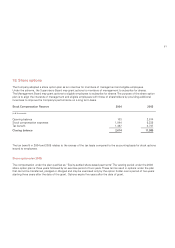

Basicearningspershare

BasicearningspershareiscalculatedbydividingtheprofitattributabletoequityholdersoftheCompanybytheweighted

averagenumberofordinarysharesoutstandingduringtheyear.

Dilutedearningspershare

Dilutedearningspershareiscalculatedbyadjustingtheweightedaveragenumberofordinarysharesoutstandingtoassume

conversionofallpotentialdilutiveordinaryshares.TheCompanyhasonecategoryofpotentialdilutiveordinaryshares:share

options.Fortheseshareoptionsacalculationisdonetodeterminethenumberofsharesthatcouldhavebeenacquiredat

fairvalue(determinedastheaverageannualmarketsharepriceoftheCompany’sshares)basedonthemonetaryvalueof

thesubscriptionrightsattachedtooutstandingshareoptions.Thenumberofsharescalculatedasaboveiscomparedwith

thenumberofsharesthatwouldhavebeenissuedassumingtheexerciseoftheshareoptions.

Theweightedaveragenumberofordinarysharesfordilutedearningspersharefortheyearsended31December2004and

theperiodupuntiltheIPOin2005,hasbeencomputedonapro-formabasisassumingthechangeinthenumberofshares

outstandingto100millionshareshadbeeneffectiveforallof2004andintheperiodupuntil13May2005respectively.