TomTom 2005 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2005 TomTom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

TreasuryPolicy

TomTom’streasuryfunctionstrivestoachievea

reasonablereturnonexcesscashresources.Themain

goalistogetareasonablereturnonthecashbalances

relativetomarketratereturns.

TomTomwillapplytheseguidelines,amongothers,to

selectinvestmentopportunitiesforitsexcesscash

balances.AllinvestmentshaveatleastanAA

-

creditrisk

ratingbyanacknowledgedinstitute.Amaximumtermof

threeyearsisused,andwithapotentiallyloweroverall

return,earlyunwindingisallowedforeachinvestment.

ThetreasuryfunctionalsocontrolsrisksforTomTom

relatingtochangesinforeigncurrencyexchangerates

(relativetotheeuro)byeffectiveandefficient

managementofforeignexchangeexposuresrelatedto

revenue,procurementandcashbalances.Themaingoal

istomakethecostofworkingwithforeigncurrencies

morepredictableandtoreducethecostofthetoolsthat

areused.Thegoalisnottoreducethecostofforeign

currenciesbyachievinglowerexchangeratesthan

marketaveragesormarketexpectations.

TomTommanagesitstransactionrisksrelatingtofuture

forecastcashflowsbyenteringintofinancialinstruments

whichmakethefuturecashflowsmorepredictable.

TomTomseekstoprotectitscostofsaleslinefrom

suddenmovementsintheUSdollarrelativetotheeuro

anditalsodoesthesameforpoundsterling-

denominatedrevenuesarisingintheUK.TomTomdoes

nothedgetranslationriski.e.:theriskwhichariseson

thetranslationofnon-eurodenominatedincome

statementsandbalancesheetsofsubsidiaries.TomTom

willonlyusesimplehedginginstruments,mainlyforward

contractsandtoafarlesserextentplainoptions.TomTom

doesnotcurrentlyapplyhedgeaccounting.

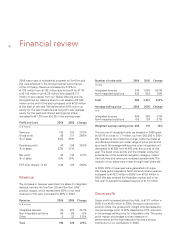

Liquidityandcapitalresources

TomTom’scashbalancesincreasedto

178millionat

theendoftheyearfrom

40millionatthestartofthe

year.Despitethesubstantialgrowthofthecompanyin

theyearwecontinuedtobecashgenerativein2005with

43millionofnetcashgeneratedfromoperating

activities.Duringtheyearweraised

117millionofnew

fundsfromthecompany’sIPOandwecompletedtwo

acquisitionswhichmadeup

15millionofthecashflow

usedininvestingactivities.

CashFlow 2004 2005

(in

millions)

Netcashflowfromoperatingactivities 36.2 43.1

Cashflowusedininvestingactivities -2.9 -21.4

Cashflowfromfinancingactivities 0 116.5

Netincreaseincashandcashequivalents 33.3 138.2

Cashandcashequivalentsatendofperiod40.2 178.4

BalanceSheet 2004 2005

(in

millions)

Non-currentassets 3.0 21.0

Currentassets 87.9 442.6

Totalassets 90.9 463.6

Capitalandreserves 37.8 306.4

Provisions 0.4 21.0

Longtermliabilities 1.3 1.0

Currentliabilities 51.4 135.2

Totalequityandliabilities 90.9 463.6

Thebalancesheetstrengthenedconsiderablyintheyear.

Netassetsatthestartoftheyearwere

38million;by

theendoftheyeartheyhadincreasedto

306million,

mainlyasaresultofthenetprofitof

143millionforthe

yearandtheIPOcapitalraisingof

117million.