Sunoco 2013 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2013 Sunoco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

Generally, we enter into contracts with producers at market prices for a term of one year or less, with a majority of the

transactions on a 30-day renewable basis. For the year ended December 31, 2013, we purchased 339 thousand bpd from

approximately 3 thousand producers who operate approximately 54 thousand active leases. We also undertook 410 thousand

bpd of exchanges and bulk purchases during the same period.

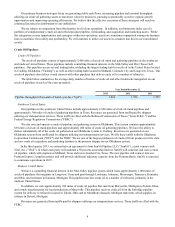

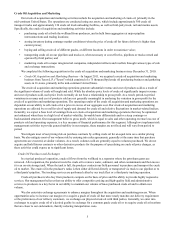

The following table shows our average daily volume for crude oil lease purchases and sales and other exchanges and bulk

purchases for the years presented:

Year Ended December 31,

2013 2012 2011

(in thousands of bpd)

Lease purchases:

Available for sale 332 283 215

Exchanged 7 6 9

Other exchanges and bulk purchases 410 384 439

Total Purchases 749 673 663

Bulk Sales 419 342 281

Exchanges:

Purchased at the lease 7 6 9

Other 321 321 370

Total Sales 747 669 660

Crude Oil Price Volatility

Crude oil commodity prices have historically been volatile and cyclical. Profitability from our Crude Oil Acquisition and

Marketing segment is dependent on our ability to sell crude oil at prices in excess of our aggregate cost. Our operations are not

directly affected by the absolute level of crude oil prices, but are affected by overall levels of supply and demand for crude oil

and relative fluctuations in market-related indices. Generally, we expect a base level of earnings from our Crude Oil

Acquisition and Marketing business, which may be optimized and enhanced when there is a high level of market volatility.

Integration between our crude oil acquisition and marketing assets, crude oil pipelines and terminal facilities allows us to

further improve upon earnings during periods when there are favorable basis differentials between various types of crude oils.

Additionally, we are able to increase our base level of earnings when there is a steep contango or backwardated market

structure.

During periods when supply exceeds the demand for crude oil in the near term, the market for crude oil is often in

contango, meaning that the price of crude oil for future deliveries is higher than the price for current deliveries. A contango

market generally has a negative impact on our lease gathering margins, but is favorable to commercial strategies associated

with tankage. Access to our crude oil storage facilities during a contango market allows us to improve our lease gathering

margins by simultaneously purchasing crude oil inventories at current prices for storage and selling forward at higher prices for

future delivery.

When there is a higher demand than supply of crude oil in the near term, the market is backwardated, meaning that the

price of crude oil for future deliveries is lower than the price for current deliveries. A backwardated market has a positive

impact on our lease gathering margins because crude oil gatherers can capture a premium for prompt deliveries. In this

environment, there is little incentive to store crude oil, as current prices are above delivery prices in the futures markets. In a

backwardated market, increased lease gathering margins provide an offset to reduced use of storage capacity.

The periods between a backwardated market and a contango market are referred to as transition periods. Depending on

the overall duration of these transition periods, how we have allocated our assets to particular strategies and the time length of

our crude oil purchase and sale contracts and storage lease agreements, these transition periods may have either an adverse or

beneficial effect on our aggregate segment profit. A prolonged transition from a backwardated market to a contango market, or

vice versa (essentially a market that is neither in pronounced backwardation nor contango), represents the most difficult

environment for our marketing activities.

Crude Oil Trucking

We own approximately 130 crude oil truck unloading facilities in the mid-continent United States with the majority

located on our pipeline system. Approximately 400 crude oil truck drivers are employed by an affiliate of our general partner

and we own and operate a proprietary fleet of approximately 300 crude oil transport trucks. The crude oil truck drivers pick up