Sunbeam 2014 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2014 Sunbeam annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fond childhood memories of a first Rawlings

baseball glove, that great camping trip in a Coleman

tent with a Coleman lantern lighting a game played

with Bicycle playing cards, or that special family

stew recipe prepared in a CrockPot slow cooker.

All these and many more happy memories come

from Jarden products. Our objective to bring the

best products to the market with the best value

proposition for consumers is at the heart of Jarden’s

DNA and is a key contributor to our success.

This past year’s strong organic sales growth is a

testament to the positive reception for our new

products by consumers. As in prior years, product

recognitions were numerous and broad, such as

Jarden’s receipt of two Edison Awards this year,

including one for our new home canning appliance,

the Ball FreshTECH Automatic Home Canning

System, winning in the Consumer Goods category.

The Winter Olympics showcased many Jarden

products with 145 competitors choosing to use

Jarden winter sports equipment in competition.

Impressively, nearly one third of them went on to

medal. Beyond awards, we meaningfully increased

our Fortune 500 ranking up 27 spots from 2013 to

#356 in 2014. We additionally moved up 79 spots

to #217 in Newsweek’s sustainability rankings.

While these awards and rankings demonstrate solid

momentum, as always we will strive to be better.

We continue to pursue acquisitions opportunistically

and 2014 was another year of successful, disciplined

acquisitions, while also focusing on integrating the

Q4 2013 Yankee Candle acquisition. Yankee Candle

performed well in 2014 and we look forward to

their continued growth and contribution to our

business in 2015. Our most meaningful acquisition

in 2014 was the third-quarter acquisition of Rexair,

which produces the Rainbow, a premium, high-

performance floor care system. In Q2, we acquired

Cadence, a Brazilian small appliance manufacturing

company that should further supplement our

category reach and geographic breadth in Brazil.

A common strategic theme to our acquisitions is

that they leverage Jarden’s portfolio strengths, but

push us further and faster. To this end, we pursued

two smaller-scale CAPEX-type acquisitions in 2014:

accelerating Yankee Candle’s Western European

expansion by buying Millefiori, an Italian-based

premium candle and fragrance company; and

agreeing to purchase Dalbello, an Italian ski

boot business to enhance our entry into the

ski boot category.

Effective and active capital deployment is a

hallmark of Jarden. Beyond acquisitions, Jarden

was active throughout 2014 in the capital markets

arena. Jarden repurchased over $200 million of its

own shares in 2014. We believe that an acquisition

of ourselves, or share repurchase, remains a

fundamentally attractive part of our capital

deployment, particularly when our trading multiples

remain below our consumer peers. In November,

reflecting our future confidence, we executed a

3-for-2 stock split, our fifth since 2002.

In this past year’s historically low interest rate

environment, we took several steps to flatten and

extend out our debt maturity profile. In March,

we issued $690 million of senior subordinated

convertible notes due 2034. The notes bear an

annual interest of 1 1/8% with a conversion price

that was set at a 22 1/2% premium from the March

11th closing price. The coupon Jarden achieved was

the lowest across all companies and industries for

our rating for 10-year plus convertible debt (since

2007) with proceeds facilitating share repurchase,

acquisition financing, and higher coupon debt

redemption. In July, we issued EUR 300 million of

senior notes due 2021 with an annual interest rate of

3 3/4%. In Q4, we refinanced and extended our credit

facility. In 2014, Jarden paid down approximately

$480 million of debt through redemption of 7 1/2%

USD and EUR senior subordinated 2020 notes.

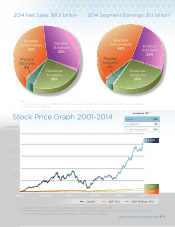

We believe that our 2014

performance has positively

contributed to the achievement of

our longer-term performance goals.

These goals, as originally presented in 2013, include:

• Delivering Long-Term Average Organic Sales

Growth of 3–5%

• Continuing to Leverage SG&A

• Expanding Segment Earnings Margins to 15%

by Year-End 2018

Jarden Corporation Annual Report 2014 3