Stein Mart 2008 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2008 Stein Mart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.discount and deep-discount chains, mass merchandisers and various privately-held companies and individuals. With the current

downturn in retail sales and the resulting pressure on manufacturers, our ability to purchase merchandise could become limited by the

consolidation or demise of merchandise vendors. Our ability to obtain merchandise may also depend on certain manufacturers’ ability

to obtain vendor financing through factoring companies, and to the extent they are unable to secure sufficient credit from those

factors, we may not be able to purchase merchandise from them. Although we do not depend on any single vendor or group of

vendors and believe we can successfully compete in seeking out new vendors, the loss of certain key vendors could make it difficult

for us to acquire sufficient quantities and an appropriate mix of merchandise, and to do so at acceptable prices which could have a

material adverse effect on our results of operations.

We are dependent on certain key personnel. Our continued success will depend to a significant extent upon the efforts and

abilities of our senior executives, and the loss of the services of one or more of these executives could have a material adverse effect

upon our results of operations. These executives are David H. Stovall, Jr., president and chief executive officer; D. Hunt Hawkins,

executive vice president and chief administrative officer; William A. Moll, executive vice president and chief merchandising officer;

James G. Delfs, senior vice president, finance and chief financial officer; Michael D. Ray, senior vice president, director of stores; as

well as Jay Stein, chairman of the board of directors, John H. Pennell, general merchandising manager, and Roseann McLean, senior

vice president of planning and allocation. Our continued success is also dependent upon our ability to attract and retain qualified

employees to meet our needs, especially to support planned growth.

Seasonality, and especially the importance of the holiday selling season. Our business is affected by the seasonal pattern

common to most retailers. Historically, our highest net sales occur during the fourth quarter, which includes the holiday selling

season. Our operating results depend significantly upon net sales generated during the fourth quarter, and any factor that negatively

impacts the holiday selling season could have a material adverse effect on our results of operations for the entire year.

If the third parties that we rely on for a majority of the distribution aspects of our business experience labor strikes or do not

adequately perform our distribution functions, our business would be disrupted. The efficient operation of our stores is

dependent on our ability to receive merchandise in our stores throughout the United States in a timely manner. We depend on

vendors to sort and pack substantially all of our merchandise and on third parties to deliver this merchandise to our stores. These

vendors and logistics providers may experience labor strikes or other disruptions in the future, the resolution of which will be out of our

control, and could result in a material disruption in our business. Any failure by these third parties to respond adequately to our

distribution needs, including labor strikes or other disruptions in the business, would disrupt our operations and negatively impact our

profitability.

Unauthorized disclosure of sensitive or confidential customer or employee information could severely damage our

reputation, expose us to risks of litigation and liability, disrupt our operations and harm our business. As part of our normal

course of business, we collect, process and retain sensitive and confidential customer and employee information. Despite the

security measures we have in place, our facilities and systems, and those of our third party service providers, may be vulnerable to

security breaches, acts of vandalism, computer viruses, misplaced or lost data, programming and/or human errors, or other similar

events. Any security breach involving the misappropriation, loss or other unauthorized disclosure of confidential information, whether

by us or our service providers, could severely damage our reputation, expose us to risks of litigation and liability, disrupt our

operations and harm our business.

Threats of terrorism or violence. Acts of terrorism or war may disrupt commerce and undermine consumer confidence, which could

negatively impact our sales revenue by causing consumer spending to decline. Also, an act of terrorism or war, or the threat thereof,

could negatively impact our business by interfering with our ability to obtain merchandise from vendors. Inability to obtain

merchandise from our vendors or substitute suppliers at similar costs in a timely manner could have a material adverse effect on our

operating results and financial condition.

Fluctuations in comparable store sales and quarterly results of operations could cause volatility in the price of our common

stock. Our comparable store sales and quarterly results have fluctuated in the past and are expected to continue to fluctuate in the

future. Comparable store sales and quarterly results of operations are affected by a variety of factors, including:

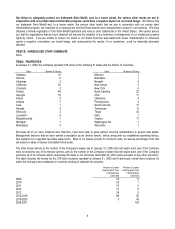

xfashion trends

xactions of competitors

xcalendar shifts of holiday or seasonal periods

xthe effectiveness of our inventory management

xchanges in our merchandise mix

xthe timing of promotional events

xstorms and other weather conditions

xchanges in general economic conditions and consumer spending patterns

7