Stein Mart 2008 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2008 Stein Mart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We have made consistent capital commitments to maintain and improve existing store facilities. During 2008, we spent approximately

$8.4 million for fixtures, equipment and leasehold improvements in stores opened prior to 2008.

As of January 31, 2009 we lease 107,342 gross square feet of office space for our corporate headquarters in Jacksonville, Florida.

We also lease a 92,000 square foot distribution/warehouse facility in Jacksonville for the purpose of processing a limited amount of

merchandise purchases (approximately three percent of our merchandise on a dollar basis).

ITEM 3. LEGAL PROCEEDINGS

The Company is involved in various routine legal proceedings incidental to the conduct of its business. Management, based upon the

advice of outside legal counsel, does not believe that any of these legal proceedings will have a material adverse effect on the

Company’s financial condition, results of operations or cash flows.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

There were no matters submitted to a vote of security holders during the fourth quarter of fiscal 2008.

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES

OF EQUITY SECURITIES

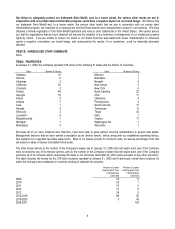

Market Price and Related Matters

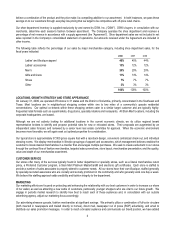

The following table sets forth the high and low sales prices of the Company’s common stock and dividends declared for each quarter

in the years ended January 31, 2009 and February 2, 2008:

Year Ended January 31, 2009 Year Ended February 2, 2008

High Low Dividend High Low Dividend

First Quarter $ 6.65 $ 4.53 $ - $17.17 $13.00 $0.0625

Second Quarter 5.90 3.66 - 15.52 10.05 0.0625

Third Quarter 5.21 1.50 - 11.26 5.92 0.0625

Fourth Quarter 2.26 0.99 - 7.99 3.29 0.0625

Stein Mart’s common stock trades on The NASDAQ Stock Market LLC under the trading symbol SMRT. On April 3, 2009, there were

1,219 stockholders of record.

Dividends

The Company began paying a quarterly dividend of $0.0625 per share in the second quarter of 2005 and continued to pay this

quarterly dividend throughout 2007. Dividends paid in 2006 included a special, one-time cash dividend of $1.50 per share. On

February 7, 2008, the Company announced that the Board of Directors had voted to suspend the payment of a quarterly dividend in

order to conserve cash until improvements occur in the Company’s business and in the current difficult retail industry conditions.

Issuer Purchases of Equity Securities

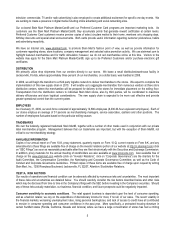

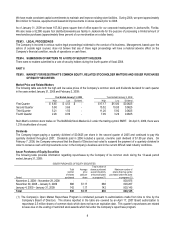

The following table provides information regarding repurchases by the Company of its common stock during the 13-week period

ended January 31, 2009:

ISSUER PURCHASES OF EQUITY SECURITIES

Period

Total

number

of shares

purchased

Average

price

paid per

share

Total number of

shares purchased

as part of publicly

announced plans

or programs (1)

Maximum number of

shares that may yet be

purchased under the plans

or programs (1)

November 2, 2008 – November 29, 2008 - - - 803,975

November 30, 2008 – January 3, 2009 688 $1.17 688 803,287

January 4, 2009 – January 31, 2009 142 1.17 142 803,145

Total 830 $1.17 830 803,145

(1) The Company’s Open Market Repurchase Program is conducted pursuant to authorizations made from time to time by the

Company’s Board of Directors. The shares reported in the table are covered by an April 17, 2007 Board authorization to

repurchase 2.5 million shares of common stock which does not have an expiration date. This quarter’s repurchases are related

to taxes due on the vesting of restricted stock awards which fall under the Company’s repurchase program.

9