Stein Mart 2008 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2008 Stein Mart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

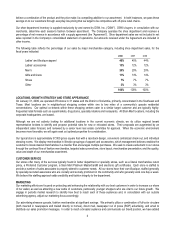

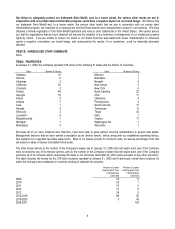

closed in 2007; and the 2006 table presents the sum of the losses from the ten stores closed during 2008, the two stores closed in

2007 and the six stores closed in 2006.

2008 2007 2006

Sales $22,729 $38,883 $53,925

Cost of merchandise sold 20,419 32,202 42,415

Gross profit 2,310 6,681 11,510

Selling, general and administrative expenses 11,902 13,426 17,201

Other income, net 259 407 575

Loss from operations $ (9,333) $ (6,338) $ (5,116)

# of stores closed in 2006-2008 10 12 18

Operating losses from closed stores include the following store closing and asset impairment charges (in thousands):

2008 2007 2006

Lease termination costs $3,568 $ 889 $1,325

Asset impairment charges 688 850 151

Severance 1,129 256 452

Total $5,385 $1,995 $1,928

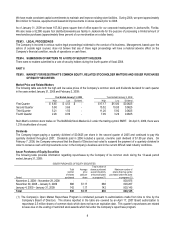

Year Ended January 31, 2009 Compared to Year Ended February 2, 2008

Net sales for the year ended January 31, 2009 were $1,326.5 million, down 9.0% from $1,457.6 million for the prior year. The $131.2

million decrease reflects a $152.2 million decrease in the comparable store group and a $16.2 million decrease in the closed store

group, offset by a $37.2 million increase in the non-comparable store group due to the inclusion of sales for the 14 stores opened in

2007 and the six stores opened in 2008. The closed store group includes the ten stores closed in 2008 and the two stores closed in

2007. Comparable stores sales for 2008 decreased 10.9% compared to 2007.

Gross profit for year ended January 31, 2009 was $294.2 million or 22.2 percent of net sales compared to $361.4 million or 24.8

percent of net sales for the prior year. The $67.2 million decrease in gross profit reflects a $64.9 million decrease in the comparable

store group and a $4.4 million decrease in the closed store group, partially offset by a $2.1 million increase in the non-comparable

store group due to the inclusion of operating results for the 14 stores opened in 2007 and the six stores opened in 2008. Gross profit

as a percent of sales decreased during fiscal 2008 due to a 1.1 percentage point increase in markdowns and a 2.0 percentage point

increase in buying and occupancy costs, offset by a 0.5 percentage point increase in markup.

SG&A expenses were $394.8 million or 29.8 percent of net sales for the year ended January 31, 2009 as compared to $388.6 million

or 26.7 percent of net sales for 2007. SG&A expenses for 2008 include $25.4 million of primarily non-cash pre-tax asset impairment

and store closing charges compared to $5.2 million in 2007. Asset impairment charges were $16.7 million higher than last year due to

a greater number of stores with projected cash flows that do not support the carrying value of their long-lived assets. Store closing

charges increased $3.5 million over last year because ten stores were closed in 2008 compared to only two store closings in 2007.

Excluding asset impairment and store closing charges, SG&A expenses were $369.3 million or 27.8 percent of sales in 2008

compared to $383.4 million or 26.3 percent of sales in 2007. This $14.1 million decrease in SG&A expenses resulted primarily from

significant reductions in advertising and store operating expenses, somewhat offset by professional fees related to expense reduction

initiatives. Advertising expenses decreased $15.2 million this year due primarily to reduced broadcast media. Store operating

expenses decreased $8.2 million for the comparable store group due to cost saving initiatives and decreased $3.4 million for the

closed store group, but were offset by an $8.9 million increase for the non-comparable store group due to the inclusion of operating

results for the 14 stores opened in 2007 and the six stores opened in 2008. Corporate SG&A expenses were higher in 2008 primarily

due to professional fees related to ongoing expense reduction initiatives and higher benefit costs, while last year included $1.8 million

of separation costs for the resignation of the former President/Chief Executive Officer. SG&A expenses as a percentage of net sales

were higher this year due to a lack of leverage on lower sales.

Pre-opening expenses for the six stores opened in 2008 and the 14 stores opened in 2007 amounted to $1.5 million and $2.7 million,

respectively.

Other income, net decreased $1.0 million in 2008 compared to 2007 due to decreases in credit card income and shoe department

income, both resulting from the decreased net sales.

14