Southwest Airlines 1999 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 1999 Southwest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.price swap agreements approximating the following percentages of 2000 anticipated fuel requirements:

57 percent for first quarter; 85 percent for second quarter; 100 percent third quarter; and 100 percent

fourth quarter. However, the Company is expecting significantly higher jet fuel prices for first quarter

2000 compared to first quarter 1999 due to the historically low prices experienced in first quarter 1999.

(The immediately preceding sentence is a forward-looking statement involving uncertainties that could

result in actual results differing materially from expected results. Such uncertainties include, but may not

be limited to, the largely unpredictable levels of jet fuel prices.) In January 2000, jet fuel prices averaged

approximately $.78 per gallon, including gains from hedging activities. The average cost of jet fuel in

January 1999 was $.3812 per gallon.

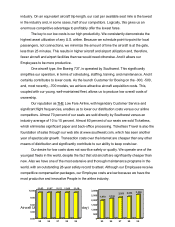

Maintenance materials and repairs per ASM increased 9.4 percent in 1999 compared to 1998.

Routine heavy maintenance or airframe inspections and repairs represented approximately 74 percent of

the increase, while engine inspection and repair costs represented approximately 25 percent of the

increase. The increase in airframe inspections and repairs was due primarily to a heavier volume of

routine airframe checks scheduled for 1999 versus 1998. Further, a portion of the Company’ s

scheduled airframe checks was outsourced in 1999 as the volume of work exceeded the available

internal headcount and facilities necessary to perform such maintenance. In 1998, the Company

performed all of this type of routine heavy maintenance internally; thus, the majority of these costs was

reflected in salaries and wages. The increases in engine inspection and repair costs were primarily

related to the Company’ s 737-200 aircraft. The Company’ s 737-200 aircraft engine inspections and

repairs are performed on a time and materials basis and are not covered by the Company’ s power-by-

the-hour engine maintenance contract with General Electric Engine Services, Inc. The 737-200 aircraft

experienced an increase both in the number of engine inspections and repairs and the average cost per

repair. Currently, we expect no material change in unit cost for maintenance materials and repairs in

2000 versus 1999. (The immediately preceding sentence is a forward-looking statement involving

uncertainties that could result in actual results differing materially from expected results. Such

uncertainties include, but may not be limited to, any unscheduled required aircraft airframe or engine

repairs.)

Agency commissions per ASM decreased 9.1 percent in 1999 compared to 1998, primarily

due to a decrease in the percentage of commissionable sales to 34.8 percent of total sales in 1999

compared to 39.8 percent in 1998. Based on recent trends, the Company expects agency commissions

to decrease on a per ASM basis in 2000. (The immediately preceding sentence is a forward-looking

statement involving uncertainties that could result in actual results differing materially from expected