Southwest Airlines 1999 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 1999 Southwest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Southwest Airlines Co. Annual Report 1999

Financial Review

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

YEAR IN REVIEW

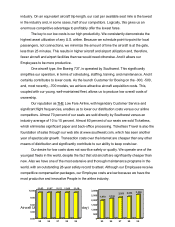

In 1999, Southwest posted a profit for the 27th consecutive year. The Company posted record

operating revenues; record operating income; the highest operating profit margin since 1981 of 16.5

percent; and a record load factor of 69.0 percent. The Company also experienced a record annual

profit for the eighth consecutive year. We experienced strong revenue growth and continued strong

demand for our product. Fuel prices in fourth quarter 1999 rose to their highest levels since 1991.

At the end of 1999, Southwest served 55 cities in 29 states. We targeted the East Coast for our

1999 expansion, adding service to Islip, New York, on Long Island in March 1999, Raleigh-Durham,

North Carolina, in June 1999, and Hartford, Connecticut, in October 1999 and have been very pleased

with the results in each of these new Southwest cities. The Company recently announced plans to

commence service to Albany, New York, in May 2000 and will begin serving at least one other new

city in 2000. In addition, we plan to continue to add flights between cities we already serve.

Capacity is expected to grow approximately 12 percent in 2000 with the net addition of at least

30 aircraft. The Company will purchase 31 new Boeing 737-700s scheduled for delivery during the

year and has agreed to a long-term lease arrangement to acquire another 737-700 in March of 2000. In

addition, two of the Company’ s older 737-200s are scheduled for retirement during the year.

RESULTS OF OPERATIONS

1999 COMPARED WITH 1998 The Company’ s consolidated net income for 1999 was

$474.4 million ($.89 per share, diluted), as compared to the corresponding 1998 amount of $433.4

million ($.82 per share, diluted), an increase of 9.4 percent. The prior years’ earnings per share amounts

have been restated for the 1999 three-for-two stock split (see Note 8 to the Consolidated Financial

Statements). Operating income increased 14.3 percent for 1999 to $781.6 million.

F2