Southwest Airlines 1999 Annual Report Download - page 17

Download and view the complete annual report

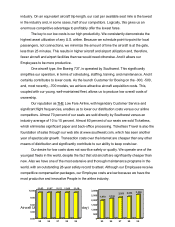

Please find page 17 of the 1999 Southwest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.OPERATING REVENUES Consolidated operating revenues increased 13.7 percent in 1999

primarily due to a 13.5 percent increase in passenger revenues. The increase in passenger revenues was

primarily due to a 9.3 percent increase in revenue passengers carried and a 16.1 percent increase in

revenue passenger miles (RPMs). The passenger revenue yield per RPM decreased 2.3 percent to

$.1233 for 1999 primarily due to an increase in average length of passenger haul of 6.2 percent partially

offset by a 3.8 percent increase in average passenger fare. The Company expects the trend toward

gradually increasing lengths of passenger haul to continue in 2000. (The immediately preceding sentence

is a forward-looking statement involving uncertainties that could result in actual results differing materially

from expected results. Such uncertainties include, but may not be limited to, competitive responses from

other air carriers and general economic conditions.)

The 16.1 percent increase in RPMs in 1999 exceeded the 11.2 percent increase in available

seat miles (ASMs), resulting in an increase in load factor from 66.1 percent in 1998 to 69.0 percent in

1999. The 1999 ASM growth resulted from the net addition of 32 aircraft during the year. Favorable

load factor and revenue trends continued in January 2000. The load factor for January 2000 was 60.1

percent, up .9 points from January 1999’ s load factor of 59.2 percent.

Freight revenues increased 4.6 percent in 1999 compared to 1998 primarily due to added

capacity and modest rate increases. Other revenues increased 31.0 percent in 1999 compared to 1998.

Approximately 54 percent of the increase was due to increased revenues from the sale of flight segment

credits to marketing partners in the Company’ s Rapid Rewards frequent flyer program, and

approximately 33 percent of the increase was due to an increase in charter revenue. Beginning January

1, 2000, the Company will change its method of accounting for the sale of flight segment credits. See

Recent Accounting Developments in Note 1 to the Consolidated Financial Statements.

OPERATING EXPENSES Consolidated operating expenses for 1999 were $3,954.0 million,

compared to $3,480.4 million in 1998, an increase of 13.6 percent, compared to the 11.2 percent

increase in capacity. Operating expenses per ASM increased 2.2 percent in 1999 primarily due to a

15.4 percent increase in average jet fuel prices. Excluding fuel expense, operating expenses per ASM

for 1999 increased 0.8 percent.

Based on current trends, unit costs are expected to continue to reflect year over year

unfavorable comparisons in first quarter 2000 as a result of higher jet fuel prices. Excluding jet fuel

costs, the Company is expecting nonfuel unit cost declines in first quarter 2000 compared to first quarter