Southwest Airlines 1999 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 1999 Southwest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1999. (The immediately preceding two sentences are forward-looking statements involving uncertainties

that could result in actual results differing materially from expected results. Such uncertainties include,

but may not be limited to, the largely unpredictable levels of jet fuel prices and any unscheduled required

aircraft airframe or engine repairs.)

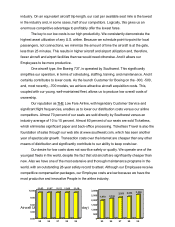

Operating expenses per ASM for 1999 and 1998 were as follows:

OPERATING EXPENSES PER ASM

1999 1998

Increase

(Decrease)

Percent

Change

Salaries, wages, and

benefits 2.39¢ 2.35¢ .04¢ 1.7%

Employee profitsharing and

savings plans .36 .35 .01 2.9

Fuel and oil .93 .82 .11 13.4

Maintenance materials and

repairs .70 .64 .06 9.4

Agency commissions .30 .33 (.03) (9.1)

Aircraft rentals .38 .43 (.05) (11.6)

Landing fees and other

rentals .46 .45 .01 2.2

Depreciation .47 .47 – –

Other 1.49 1.48 .01 0.7

Total 7.48¢ 7.32¢ .16¢ 2.2%

Salaries, wages, and benefits per ASM increased 1.7 percent in 1999. This increase resulted

primarily from increases in benefits costs, specifically workers compensation and health care expense.

Employee profitsharing and savings plans expense per ASM increased slightly due to higher

earnings available for profitsharing.

Fuel and oil expenses per ASM increased 13.4 percent in 1999, primarily due to a 15.4

percent increase from 1998 in the average jet fuel cost per gallon. The average price paid for jet fuel in

1999 was $.5271, including the effects of hedging activities, compared to $.4567 in 1998. The

Company’ s 1999 average jet fuel price is net of approximately $14.8 million in gains from hedging

activities. Hedging activities in 1998 were not significant. For fourth quarter 1999, the average cost per

gallon increased 54.5 percent to $.6713 compared to $.4346 in fourth quarter 1998, including the

effects of hedging activities. As of February 24, 2000, the Company had hedged its exposure to fuel

price increases with combinations of purchased crude oil call options, crude oil collars, and/or fixed