Shutterfly 2015 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2015 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

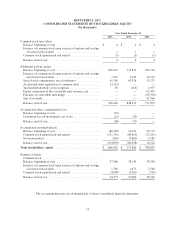

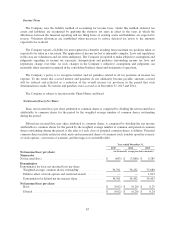

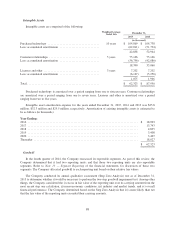

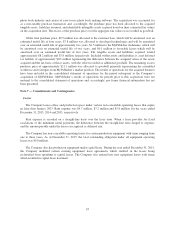

The following weighted-average outstanding stock options and restricted stock units were excluded from the

computation of diluted net income/(loss) per common share for the periods presented because including them

would have had an anti-dilutive effect (in thousands):

Year ended December 31,

2015 2014 2013

Stock options and restricted stock units ........................ 4,185 4,205 24

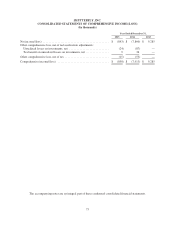

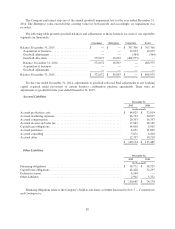

Comprehensive Income

Comprehensive income is defined as the change in equity of a business enterprise during a period from

transactions and other events and circumstances from non-owner sources. Comprehensive income is composed of

net income/(loss) and other comprehensive income/(loss). The Company’s other comprehensive income/(loss)

consists of unrealized gains and losses on marketable securities classified as available-for-sale.

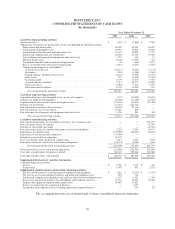

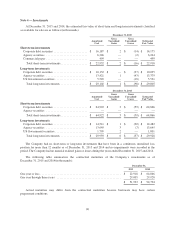

Segment Reporting

The Company reports as two operating segments with the Chief Executive Officer (“CEO”) acting as the

Company’s chief operating decision maker. The Company defined two reportable segments based on factors such

as how management manages the operations and how its chief operating decision maker views results. The

Company has the following reportable segments:

Consumer — Includes sales from the Company’s brands and are derived from the sale of photo-based

products, such as photo books, stationery and greeting cards, other photo-based merchandise, photo prints,

and the related shipping revenues as well as rental revenue from its BorrowLenses brand.

Enterprise — Includes revenues primarily from variable, four-color direct marketing collateral

manufactured and fulfilled for business customers.

In addition to the above reportable segments, the Company has a corporate category that includes activities

that are not directly attributable or allocable to a specific segment. This category consists of stock-based

compensation and amortization of intangible assets.

Recent Accounting Pronouncements

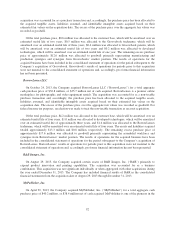

In May 2014, the Financial Accountings Standards Board (“FASB”) issued new accounting guidance related

to revenue recognition. This new standard will replace all current U.S. GAAP guidance on this topic and

eliminate all industry-specific guidance. The new revenue recognition standard provides a unified model to

determine when and how revenue is recognized. The core principle is that a company should recognize revenue

to depict the transfer of promised goods or services to customers in an amount that reflects the consideration for

which the entity expects to be entitled in exchange for those goods or services. This guidance will be effective for

the Company beginning January 1, 2018 and can be applied either retrospectively to each period presented or as a

cumulative-effect adjustment as of the date of adoption. The Company is evaluating the impact, if any, of

adopting this new accounting guidance on its financial statements.

In August 2014, the FASB issued new guidance related to the disclosures around going concern. The new

standard provides guidance around management’s responsibility to evaluate whether there is substantial doubt

about an entity’s ability to continue as a going concern and to provide related footnote disclosures. The new

standard is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15,

2016. Early adoption is permitted. The adoption of this standard is not expected to have a material impact on the

Company’s financial statements.

84