Shutterfly 2015 Annual Report Download - page 106

Download and view the complete annual report

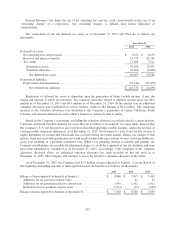

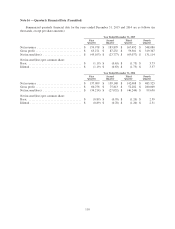

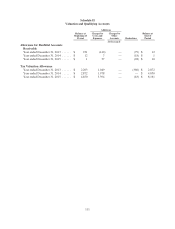

Please find page 106 of the 2015 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.During the current year, $3.8 million of prior year unrecognized tax benefits were recognized as a result of

our 2010 audit, providing a current income tax benefit of $1.6 million.

If the $5.7 million of unrecognized tax benefits as of December 31, 2015 is recognized, approximately $2.1

million would decrease the effective tax rate in the period in which each of the benefits is recognized. The

remaining amount would be offset by the reversal of related deferred tax assets on which a valuation allowance is

placed. The Company does not expect any material changes to its unrecognized tax benefits within the next

twelve months.

The Company provides for federal income taxes on the earnings of its foreign subsidiary, as such, earnings

are currently recognized as US taxable income.

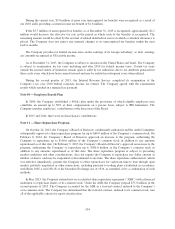

As of December 31, 2015, the Company is subject to taxation in the United States and Israel. The Company

is subject to examination for tax years including and after 2010 for federal income taxes. Certain tax years

outside the normal statute of limitation remain open to audit by tax authorities due to tax attributes generated in

those early years which have been carried forward and may be audited in subsequent years when utilized.

During the second quarter of 2015, the Internal Revenue Service completed its examination of the

Company’s tax year 2010 federal corporate income tax returns. The Company agreed with the examination

results which resulted in a minimal tax payment.

Note 10 — Employee Benefit Plan

In 2000, the Company established a 401(k) plan under the provisions of which eligible employees may

contribute an amount up to 50% of their compensation on a pre-tax basis, subject to IRS limitations. The

Company matches employees’ contributions at the discretion of the Board.

In 2015 and 2014, there were no discretionary contributions.

Note 11 — Share Repurchase Program

On October 24, 2012, the Company’s Board of Directors conditionally authorized and the Audit Committee

subsequently approved a share repurchase program for up to $60.0 million of the Company’s common stock. On

February 6, 2014, the Company’s Board of Directors approved an increase to the program, authorizing the

Company to repurchase up to $100.0 million of the Company’s common stock in addition to any amounts

repurchased as of that date. On February 9, 2015, the Company’s Board of Director’s approved an increase to the

program, authorizing the Company to repurchase up to $300.0 million of the Company’s common stock in

addition to any amounts repurchased as of that date. The share repurchase program is subject to prevailing

market conditions and other considerations; does not require the Company to repurchase any dollar amount or

number of shares; and may be suspended or discontinued at any time. The share repurchase authorization, which

was effective immediately, permits the Company to effect repurchases for cash from time to time through open

market, privately negotiated or other transactions, including pursuant to trading plans established in accordance

with Rules 10b5-1 and 10b-18 of the Securities Exchange Act of 1934, as amended, or by a combination of such

methods.

In May 2015, the Company entered into an accelerated share repurchase agreement (“ASR”) with a financial

institution to repurchase shares of its common stock. Under the ASR, the Company prepaid $75.0 million in the

second quarter of 2015. The Company accounted for the ASR as a forward contract indexed to the Company’s

own common stock. The Company has determined that the forward contract, indexed to its common stock, met

all of the applicable criteria for equity classification.

104