Shutterfly 2015 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2015 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

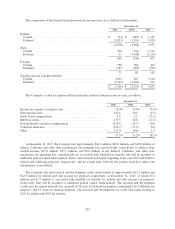

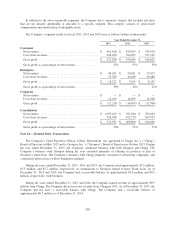

In addition to the above reportable segments, the Company has a corporate category that includes activities

that are not directly attributable or allocable to a specific segment. This category consists of stock-based

compensation and amortization of intangible assets.

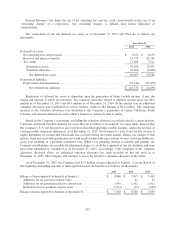

The Company’s segment results for fiscal 2015, 2014 and 2013 were as follows (dollars in thousands):

Year Ended December 31,

2015 2014 2013

Consumer

Net revenues ....................................... $ 961,418 $ 870,959 $ 745,970

Cost of net revenues ................................. 436,050 394,265 327,145

Gross profit ........................................ $ 525,368 $ 476,694 $ 418,825

Gross profit as a percentage of net revenues ............... 55% 55% 56%

Enterprise

Net revenues ....................................... $ 98,011 $ 50,621 $ 37,672

Cost of net revenues ................................. 79,789 43,456 29,480

Gross profit ........................................ $ 18,222 $ 7,165 $ 8,192

Gross profit as a percentage of net revenues ............... 19% 14% 22%

Corporate

Net revenues ....................................... $ — $ — $ —

Cost of net revenues ................................. 12,239 14,999 12,968

Gross profit ........................................ $ (12,239) $ (14,999) $ (12,968)

Consolidated

Net revenues ....................................... $ 1,059,429 $ 921,580 $ 783,642

Cost of net revenues ................................. 528,078 452,720 369,593

Gross profit ........................................ $ 531,351 $ 468,860 $ 414,049

Gross profit as a percentage of net revenues ............... 50% 51% 53%

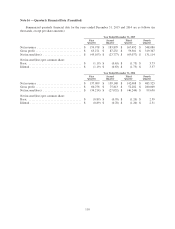

Note 14 — Related Party Transactions

The Company’s Chief Executive Officer, Jeffrey Housenbold, was appointed to Chegg, Inc.’s (“Chegg”)

Board of Directors in May 2013 and to Groupon, Inc.’s (“Groupon”) Board of Directors in October 2013. During

the year ended December 31, 2015, the Company conducted business with both Groupon and Chegg. The

Company’s business with Groupon during the year consisted primarily of offering its products as part of

Groupon’s flash deals. The Company’s business with Chegg primarily consisted of advertising campaigns, and

commercial print services with its Enterprise segment.

During the years ended December 31, 2015, 2014 and 2013, the Company paid approximately $3.5 million,

$3.3 million, and $2.7 million, respectively, in commissions to Groupon related to these Flash deals. As of

December 31, 2015 and 2014, the Company had a receivable balance of approximately $0.8 million and $0.5

million, respectively, with Groupon.

During the years ended December 31, 2015 and 2014, the Company earned revenue of approximately $0.5

million from Chegg. The Company did not earn any revenue from Chegg in 2013. As of December 31, 2015, the

Company did not have a receivable balance with Chegg. The Company had a receivable balance of

approximately $0.5 million as of December 31, 2014.

108