Shutterfly 2015 Annual Report Download - page 54

Download and view the complete annual report

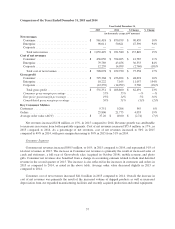

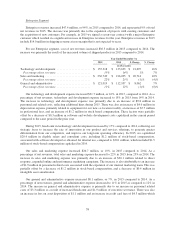

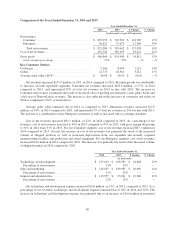

Please find page 54 of the 2015 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Sales and marketing expense consists of costs incurred for marketing programs, and personnel and related

expenses for our customer acquisition, product marketing, business development, and public relations activities.

Our marketing efforts consist of various online and offline media programs, such as e-mail and direct mail

promotions, radio advertising, television advertising, the purchase of keyword search terms and various strategic

alliances. We depend on these efforts to attract customers to our service.

General and administrative expense includes general corporate costs, including rent for our corporate offices,

insurance, depreciation on information technology equipment, and legal and accounting fees. Transaction costs

are also included in general and administrative expense. In addition, general and administrative expense includes

personnel expenses of employees involved in executive, finance, accounting, human resources, information

technology and legal roles. Third-party payment processor and credit card fees are also included in general and

administrative expense and have historically fluctuated based on revenues during the period. All of the payments

we have received from our intellectual property license agreements have been included as an offset to general

and administrative expense.

Interest Expense. Interest expense consists of interest on our convertible senior notes arising from

amortization of debt discount, amortization of debt issuance costs, and our 0.25% coupon payment; costs

associated with our five-year syndicated credit facility that became effective in November 2011, as amended in

May and December 2013; and costs associated with our capital leases and build-to-suit lease financing

obligations.

Interest and Other Income, Net. Interest and other income, net primarily consists of the interest earned on

our cash and investment accounts and realized gains and losses on the sale of our investments.

Income Taxes. We account for income taxes under the liability method. Under this method, deferred tax

assets and liabilities are determined based on the difference between the financial statement and tax basis of

assets and liabilities. We are subject to taxation in the United States and Israel.

Critical Accounting Policies and Estimates

Our consolidated financial statements are prepared in accordance with accounting principles generally

accepted in the United States, or GAAP. The preparation of these consolidated financial statements requires us to

make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues, costs and

expenses, and related disclosures. We base our estimates on historical experience and on various other

assumptions that we believe to be reasonable under the circumstances. In many instances, we could have

reasonably used different accounting estimates, and in other instances, changes in the accounting estimates are

reasonably likely to occur from period to period. Accordingly, actual results could differ significantly from the

estimates made by our management. To the extent that there are material differences between these estimates and

actual results, our future financial statement presentation of our financial condition or results of operations will

be affected.

In many cases, the accounting treatment of a particular transaction is specifically dictated by GAAP and

does not require management’s judgment in its application, while in other cases, management’s judgment is

required in selecting among available alternative accounting standards that allow different accounting treatment

for similar transactions. We believe that the accounting policies discussed below are the most critical to

understanding our historical and future performance, as these policies relate to the more significant areas

involving management’s judgments and estimates.

Revenue Recognition. We recognize revenue from Consumer and Enterprise product sales, net of

applicable sales tax, upon shipment of fulfilled orders, when persuasive evidence of an arrangement exists, the

52