Shutterfly 2015 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2015 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• during the five business day period after any ten consecutive trading day period (the “Notes

Measurement Period”) in which the “trading price” (as the term is defined in the Indenture) per

$1,000 principal amount of notes for each trading day of such Notes Measurement Period was

less than 98% of the product of the last reported sale price of the Company’s common stock on

such trading day and the conversion rate on each such trading day;

• upon the occurrence of specified corporate events; or

• at any time on or after December 15, 2017 until the close of business on the second scheduled

trading immediately preceding the maturity date.

As of December 31, 2015, the Notes were not yet convertible.

In accounting for the issuance of the Notes, the Company separated the Notes into liability and equity

components. The carrying amount of the liability component was calculated by measuring the fair value of a

similar liability that does not have an associated convertible feature. The carrying amount of the equity

component representing the conversion option was determined by deducting the fair value of the liability

component from the face value of the Notes as a whole. The excess of the principal amount of the liability

component over its carrying amount (“debt discount”) is amortized to interest expense over the term of the Notes.

The equity component is not remeasured as long as it continues to meet the conditions for equity classification.

In accounting for the transaction costs related to the Note issuance, the Company allocated the total amount

incurred to the liability and equity components based on their relative values. Issuance costs attributable to the

liability component, totaling $6.4 million , are being amortized to expense over the term of the Notes, and

issuance costs attributable to the equity component, totaling $1.7 million, were netted with the equity component

in stockholders’ equity. Additionally, the Company recorded a deferred tax asset of $0.6 million on a portion of

the equity component transaction costs which are deductible for tax purposes.

Concurrently with the Note issuance, the Company repurchased 0.6 million shares of common stock for

approximately $30.0 million .

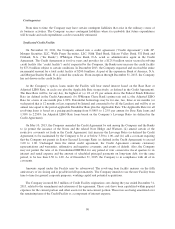

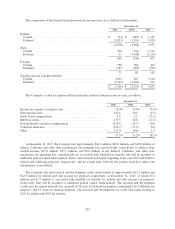

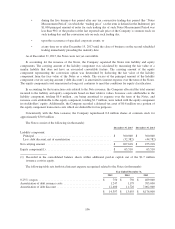

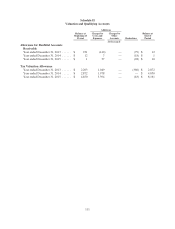

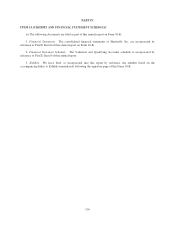

The Notes consist of the following (in thousands):

December 31, 2015 December 31, 2014

Liability component:

Principal .................................................... $ 300,000 $ 300,000

Less: debt discount, net of amortization ........................... (32,382) (44,782)

Net carrying amount ............................................ $ 267,618 $ 255,218

Equity component(1) ............................................ $ 63,510 63,510

(1) Recorded in the consolidated balance sheets within additional paid-in capital, net of the $1.7 million

issuance costs in equity.

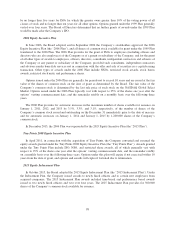

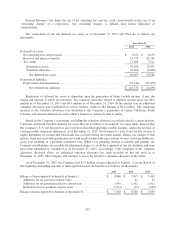

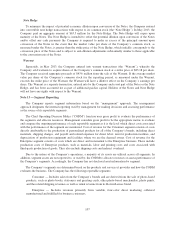

The following table sets forth total interest expense recognized related to the Notes (in thousands):

Year Ended December 31,

2015 2014 2013

0.25% coupon .......................................... $ 750 $ 750 $ 469,000

Amortization of debt issuance costs ......................... 1,247 1,179 705,000

Amortization of debt discount .............................. 12,400 11,726 7,002,000

$ 14,397 $ 13,655 $ 8,176,000

106