Sharp 2006 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2006 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

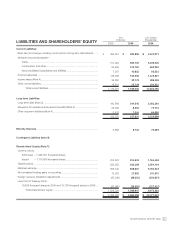

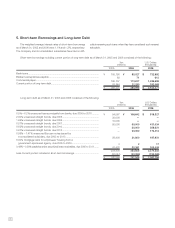

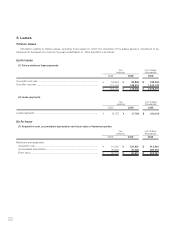

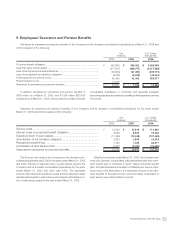

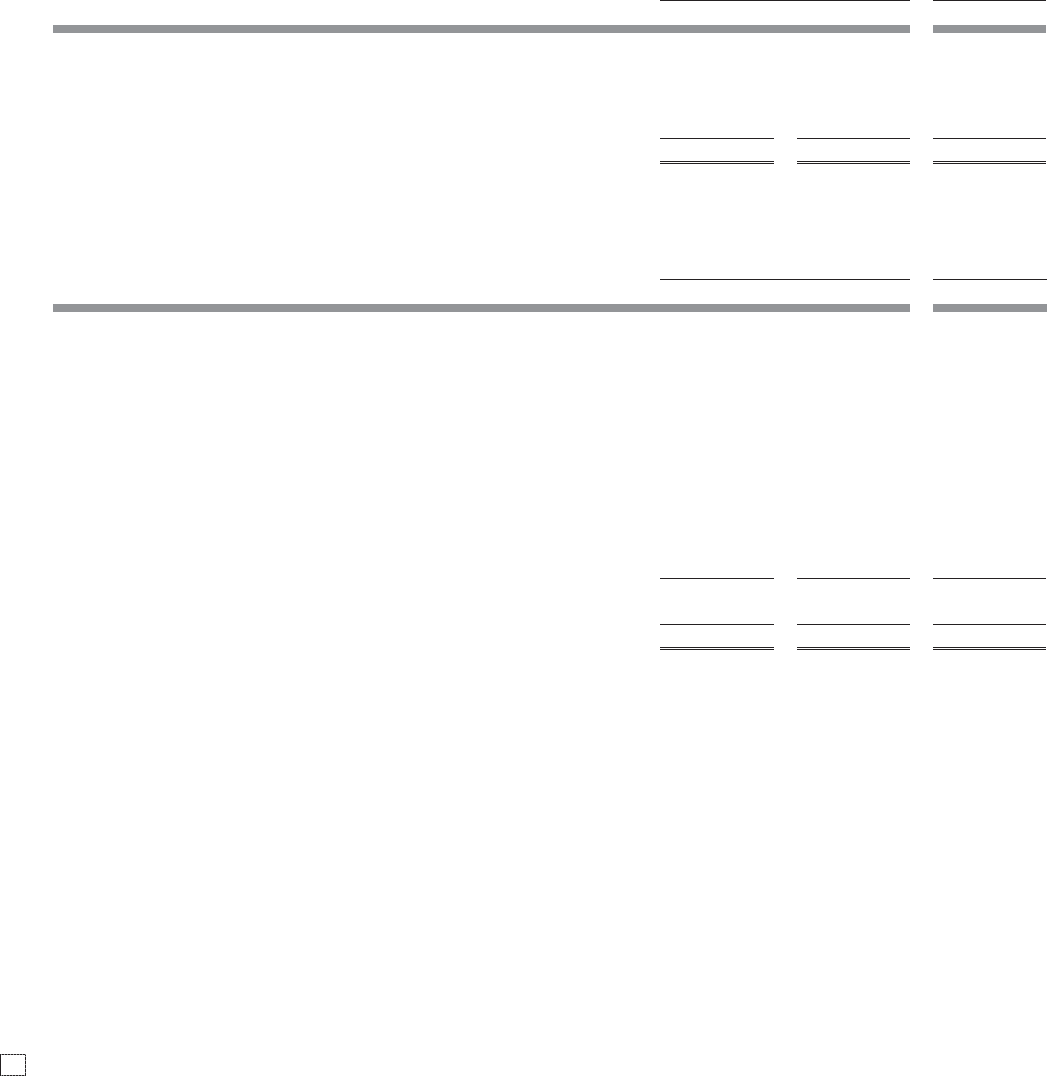

5. Short-term Borrowings and Long-term Debt

The weighted average interest rates of short-term borrowings

as of March 31, 2005 and 2006 were 1.1% and 1.2%, respectively.

The Company and its consolidated subsidiaries have had no diffi-

culty in renewing such loans when they have considered such renewal

advisable.

Bank loans........................................................................................................

Banker’s acceptances payable .........................................................................

Commercial paper.............................................................................................

Current portion of long-term debt......................................................................

$ 732,992

612

1,496,698

192,069

$ 2,422,371

¥ 85,027

71

173,617

22,280

¥ 280,995

¥ 105,190

80

165,737

93,544

¥ 364,551

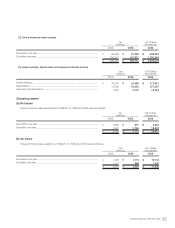

Long-term debt as of March 31, 2005 and 2006 consisted of the following:

0.0%—6.2% unsecured loans principally from banks, due 2005 to 2018..........

2.00% unsecured straight bonds, due 2005......................................................

1.65% unsecured straight bonds, due 2005......................................................

0.57% unsecured straight bonds, due 2007......................................................

0.62% unsecured straight bonds, due 2010......................................................

0.97% unsecured straight bonds, due 2012......................................................

0.05%—1.47% unsecured Euroyen notes issued by

a consolidated subsidiary, due 2005 to 2013.................................................

6.00% mortgage loans for employees’ housing from a

government-sponsored agency, due 2005 to 2009........................................

0.48%—0.93% payables under securitized lease receivables, due 2005 to 2011

.......

Less-Current portion included in short-term borrowings....................................

$ 919,327

—

—

431,034

258,621

172,414

187,931

17

305,009

2,274,353

(192,069)

$ 2,082,284

¥ 106,642

—

—

50,000

30,000

20,000

21,800

2

35,381

263,825

(22,280)

¥ 241,545

¥ 94,567

30,000

10,000

50,000

—

—

28,400

3

41,438

254,408

(93,544)

¥ 160,864

200620062005

Yen

(millions) U.S. Dollars

(thousands)

200620062005

Yen

(millions) U.S. Dollars

(thousands)

Short-term borrowings including current portion of long-term debt as of March 31, 2005 and 2006 consisted of the following: