Sharp 2006 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2006 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHARP ANNUAL REPORT 2006 44

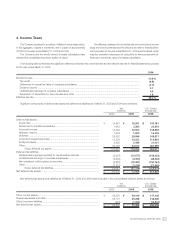

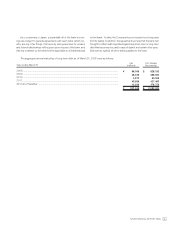

The following table summarizes the significant differences between the normal tax rate and the effective tax rate for financial statement purposes

for the year ended March 31, 2006:

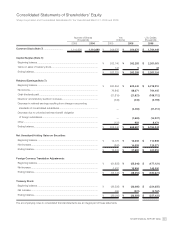

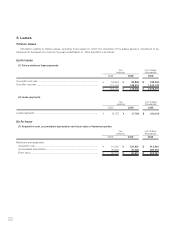

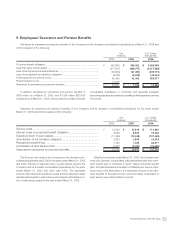

Deferred tax assets:

Inventories.....................................................................................................

Allowance for doubtful receivables ................................................................

Accrued bonuses .........................................................................................

Warranty reserve ...........................................................................................

Software .......................................................................................................

Long-term prepaid expenses ........................................................................

Enterprise taxes ............................................................................................

Other.............................................................................................................

Gross deferred tax assets .....................................................................

Deferred tax liabilities:

Retained earnings appropriated for tax allowable reserves ............................

Undistributed earnings of overseas subsidiaries ............................................

Net unrealized holding gains on securities .....................................................

Other.............................................................................................................

Gross deferred tax liabilities...................................................................

Net deferred tax assets .....................................................................................

$ 140,181

20,345

108,638

16,405

246,517

114,845

21,431

281,655

950,017

(108,422)

(28,448)

(167,164)

(21,345)

(325,379)

$ 624,638

¥ 16,261

2,360

12,602

1,903

28,596

13,322

2,486

32,672

110,202

(12,577)

(3,300)

(19,391)

(2,476)

(37,744)

¥ 72,458

¥ 14,461

1,942

12,449

1,608

25,362

13,308

2,405

35,738

107,273

(9,997)

(2,592)

(9,229)

(3,223)

(25,041)

¥ 82,232

200620062005

Yen

(millions) U.S. Dollars

(thousands)

Significant components of deferred tax assets and deferred tax liabilities as of March 31, 2005 and 2006 were as follows:

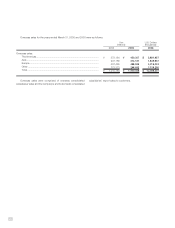

Normal tax rate..............................................................................................................................................................

Tax credit.................................................................................................................................................................

Differences in normal tax rates of overseas subsidiaries............................................................................................

Dividend income ......................................................................................................................................................

Undistributed earnings of overseas subsidiaries .......................................................................................................

Expenses not deductible for tax purposes and other................................................................................................

Effective tax rate............................................................................................................................................................

40.6 %

(6.8)

(2.0)

2.1

0.5

1.8

36.2 %

2006

4. Income Taxes

The Company is subject to a number of different income taxes which,

in the aggregate, indicate a normal tax rate in Japan of approximately

40.6% for the years ended March 31, 2005 and 2006.

The Company and the wholly owned domestic subsidiaries have

adopted the consolidated tax return system of Japan.

The difference between the normal tax rate on income before income

taxes and minority interests and the effective tax rate for financial state-

ment purposes for the year ended March 31, 2005 was immaterial, which

was due primarily to expenses not deductible for tax purposes and dif-

ferences in normal tax rates of overseas subsidiaries.

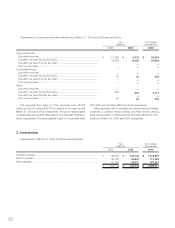

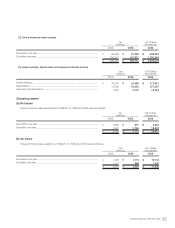

Other current assets..........................................................................................

Prepaid expenses and other..............................................................................

Other long-term liabilities...................................................................................

Net deferred tax assets .....................................................................................

$ 417,405

218,086

(10,853)

$ 624,638

¥ 48,419

25,298

(1,259)

¥ 72,458

¥ 44,579

38,101

(448)

¥ 82,232

Net deferred tax assets and liabilities as of March 31, 2005 and 2006 were included in the consolidated balance sheets as follows:

200620062005

Yen

(millions) U.S. Dollars

(thousands)