Sharp 2006 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2006 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

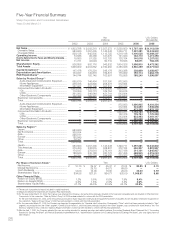

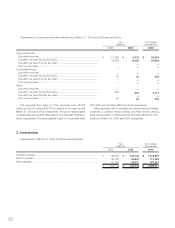

02 03 04 0605

175

133

145

193

200

160

120

80

40

0

159

02 03 04 0605

147

170

248

0

50

100

150

200

250

238

243

02 03 04 0605

2,385

1,966

2,560

3,000

2,400

1,800

1,200

600

0

2,004

2,150

02 03 04 0605

273

0

50

100

150

200

250

300

350

325

0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

284 284

336

33

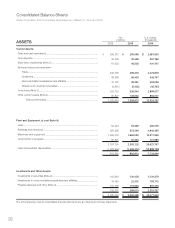

deposits over three months and bonds and others, decreased by

¥14,970 million to ¥46,533 million. Inventories stood at ¥336,344

million, up ¥10,621 million. The inventory ratio against monthly

turnover was 1.4 months, an improvement of 0.1 months.

Finished products were down ¥15,296 million to ¥164,706 million,

work in process was up ¥18,862 million to ¥82,625 million, and

raw materials were up ¥7,055 million to ¥89,013 million.

Plant and equipment increased by ¥63,031 million to

¥896,913 million due mainly to investment in the Kameyama Plant.

Investments and other assets stood at ¥268,513 million,

up ¥37,982 million due primarily to an increase in investments

in securities.

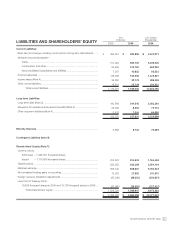

[Liabilities]

Current liabilities increased by ¥15,533 million over the previ-

ous year-end to ¥1,195,054 million. Short-term borrowings

decreased by ¥83,556 million to ¥280,995 million. Of this amount,

bank loans decreased by ¥20,163 million to ¥85,027 million, com-

mercial paper increased by ¥7,880 million to ¥173,617 million and

current portion of long-term debt decreased by ¥71,264 million to

¥22,280 million due mainly to the redemption of unsecured

straight bonds. Notes and accounts payable were ¥691,756 mil-

lion, an increase of ¥77,918 million.

Long-term liabilities were ¥257,601 million, up ¥65,310 million

from the previous year-end. This was due mainly to an increase of

¥80,681 million in long-term debt from the issuance of unsecured

straight bonds, despite a decrease of ¥16,457 million in allowance

for severance and pension benefits.

Interest-bearing debt was ¥522,469 million, down ¥2,866

million.

[Shareholders’ Equity]

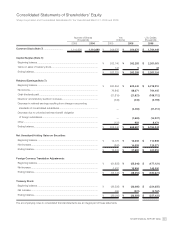

Retained earnings increased by ¥63,247 million over the previ-

ous year-end to ¥668,687 million, due mainly to the increase in net

income. Net unrealized holding gains on securities increased by

¥14,659 million to ¥27,992 million due to the increase in stock price

of shares held. Foreign currency translation adjustments generated

a gain of ¥16,994 million owing to variation in the year-end

exchange rate. As a result, total shareholders’ equity increased by

¥94,584 million to ¥1,098,910 million, while the equity ratio was 42.9%.

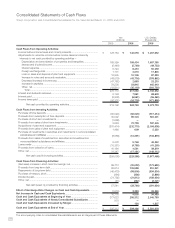

Cash Flows

Cash and cash equivalents at the end of the year were

¥299,466 million, an increase of ¥4,154 million over the previous

Ratio to monthly turnover

Depreciation and

Amortization

Capital Investment Total Assets Inventories

(billions of yen) (billions of yen) (billions of yen) (billions of yen) (month)