Sharp 2005 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2005 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHARP ANNUAL REPORT 200541

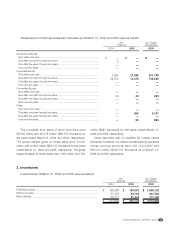

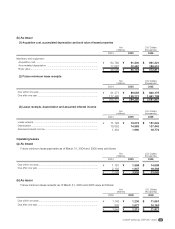

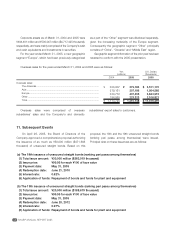

8. Contingent Liabilities

As of March 31, 2005, the Company and its consolidated subsidiaries had contingent liabilities as follows:

Loans guaranteed.........................................................................................................................

Notes discounted.........................................................................................................................

$ 92,179

5,047

$ 97,226

¥ 9,771

535

¥ 10,306

20052005

Yen

(millions) U.S. Dollars

(thousands)

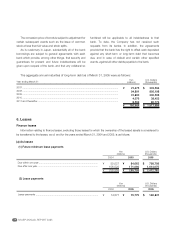

The Japanese Commercial Code provides that at least

one-half of the proceeds from shares issued be included in

common stock and the remaining amount of the proceeds be

accounted for as additional paid-in capital, which is

included in capital surplus.

T

he Company used its treasury stock in connection with

the conversion of bonds for the year ended March 31,

2005. The difference of carrying values of the bonds

converted and treasury stocks provided was included in

capital surplus.

The Code provides that an amount equivalent to at least

10% of cash dividends paid and other cash outlays shall be

appropriated and set aside as legal reserve until the total

amount of legal reserve and additional paid-in capital equals

25% of the stated capital.

As of March 31, 2005, the total amount of legal reserve

and additional paid-in capital exceeded 25% of the stated

capital and, therefore, no additional provision is required.

On condition that the total amount of legal reserve and

additional paid-in capital remains being equal to or

exceeding 25% of the stated capital, they are available for

distribution by the resolution of the shareholders’ meeting.

Legal reserve is included in retained earnings.

Year end cash dividends are approved by the

shareholders after the end of each fiscal year and

semiannual interim cash dividends are declared by the

Board of Directors after the end of each interim six-month

period. Such dividends are payable to shareholders of

record at the end of each fiscal year or interim six-month

period. In accordance with the Code, final cash dividends and

the related appropriations of retained earnings have not

been reflected in the financial statements at the end of such

fiscal year. However, cash dividends per share shown in the

accompanying consolidated statements of income reflect

dividends applicable to the respective period.

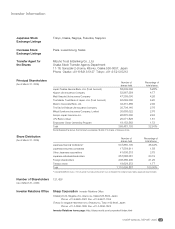

On June 23, 2005, the shareholders approved the

declaration of year end cash dividends totaling ¥10,910 million

($102,925 thousand) to shareholders of record as of March

31, 2005, covering the year then ended.

On June 24, 2004, the Ordinary General Meeting of

Shareholders passed a resolution on modifying the articles

of incorporation to allow the Company to purchase its

outstanding shares upon approval of the Board of Directors

in conformity with Article 211-3 of the Japanese

Commercial Code.

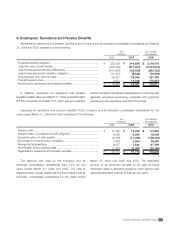

7. Shareholders’ Equity and Per Share Data