Sharp 2005 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2005 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHARP ANNUAL REPORT 2005 32

(a)

Basis of presenting consolidated financial statements

Sharp Corporation (the “Company”) and its domestic

consolidated subsidiaries maintain their official accounting

records in Japanese yen and in accordance with the

provisions set forth in the Japanese Securities and

Exchange Law and its related accounting regulations, and in

conformity with accounting principles generally accepted in

Japan, (“Japanese GAAP”) which are different in certain

respects as to application and disclosure requirements of

International Financial Reporting Standards.

The accounts of overseas consolidated subsidiaries are

based on their accounting records maintained in conformity

with generally accepted accounting principles prevailing in

the respective countries of domicile. The accompanying

consolidated financial statements have been restructured

and translated into English (with some expanded

descriptions and the inclusion of consolidated statements of

shareholders’ equity) from the consolidated financial

statements of the Company prepared in accordance with

Japanese GAAP and filed with the appropriate Local

Finance Bureau of the Ministry of Finance as required by the

Securities and Exchange Law. Some supplementary

information included in the statutory Japanese language

consolidated financial statements, but not required for fair

presentation, is not presented in the accompanying

consolidated financial statements.

The translations of the Japanese yen amounts into U.S.

dollars are included solely for the convenience of readers

outside Japan, using the prevailing exchange rate at March 31,

2005, which was ¥106 to U.S. $1.00. The convenience

translations should not be construed as representations that

the Japanese yen amounts have been, could have been, or

could in the future be, converted into U.S. dollars at this or any

other rate of exchange.

(b) Principles of consolidation

The accompanying consolidated financial statements

include the accounts of the Company and significant

companies over which the Company has power of control

through majority voting right or existence of certain

conditions evidencing control by the Company. Investments in

nonconsolidated subsidiaries and affiliates over which the

Company has the ability to exercise significant influence

over operating and financial policies of the investees, are

accounted for on the equity method.

In the elimination of investments in consolidated

subsidiaries, the assets and liabilities of the subsidiaries,

including the portion attributable to minority shareholders,

are evaluated using the fair value at the time the Company

acquired control of the respective subsidiaries.

Material intercompany balances, transactions and profits

have been eliminated in consolidation.

(c) Translation of foreign currencies

Monetary assets and liabilities denominated in foreign

currency are translated into Japanese yen at current rates at

each balance sheet date and the resulting translation gains or

losses are charged to income currently.

As to translation of financial statements of overseas

subsidiaries and affiliates, assets and liabilities are

translated at current rates at each balance sheet date,

shareholders’ equity accounts are translated at historical

rates, and revenues and expenses are translated at

average rates prevailing during the year. The resulting

foreign currency translation adjustments are shown as a

separate component of shareholders’ equity.

(d) Cash and cash equivalents

Cash and cash equivalents include cash on hand,

deposits placed with banks on demand and highly liquid

investments with insignificant risk of changes in value which

have maturities of three months or less when purchased.

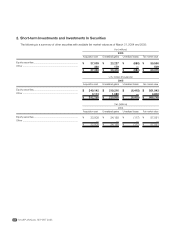

(e) Short-term investments and investments in securities

Short-term investments consist of certificates of

deposits and interest-bearing securities.

Investments in securities consist principally of

marketable and nonmarketable equity securities and

interest-bearing securities.

The Company and its domestic consolidated

subsidiaries categorize those securities as “other securities”,

which, in principle, include all securities other than trading

securities and held-to-maturity securities.

Other securities with available fair market values are

1. Summary of Significant Accounting and Reporting Policies

Notes to Consolidated Financial Statements

Sharp Corporation and Consolidated Subsidiaries