Sharp 2005 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2005 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

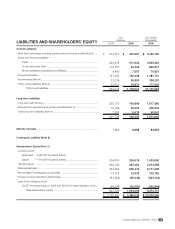

SHARP ANNUAL REPORT 2005 38

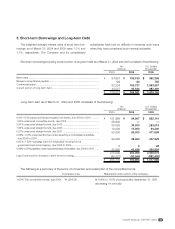

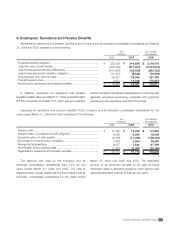

Bank loans........................................................................................................

Banker’s acceptances payable .........................................................................

Commercial paper.............................................................................................

Current portion of long-term debt......................................................................

$ 992,358

755

1,563,557

882,490

$ 3,439,160

¥ 105,190

80

165,737

93,544

¥ 364,551

¥ 84,987

129

82,234

48,227

¥ 215,577

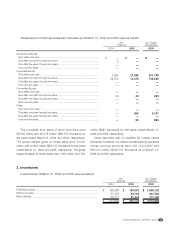

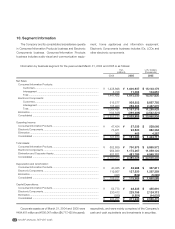

Long-term debt as of March 31, 2004 and 2005 consisted of the following:

0.0%–3.5% unsecured loans principally from banks, due 2004 to 2018 ...........

1.60% unsecured convertible bonds, due 2004 ...............................................

2.00% unsecured straight bonds, due 2005 .....................................................

1.65% unsecured straight bonds, due 2005 .....................................................

0.57% unsecured straight bonds, due 2007 .....................................................

0.05%–1.47% unsecured Euroyen notes issued by a consolidated subsidiary,

due 2004 to 2008 ...........................................................................................

6.00%–7.20% mortgage loans for employees’ housing from a

government-sponsored agency, due 2004 to 2009.........................................

0.48%

–

0.93% payables under securitized lease receivables, due 2004 to 2011

......

Less-Current portion included in short-term borrowings....................................

$ 892,141

—

283,019

94,340

471,698

267,925

28

390,924

2,400,075

(882,490)

$ 1,517,585

¥ 94,567

—

30,000

10,000

50,000

28,400

3

41,438

254,408

(93,544)

¥ 160,864

¥ 101,966

26,940

30,000

10,000

50,000

29,400

6

25,690

274,002

(48,227)

¥ 225,775

200520052004

Yen

(millions) U.S. Dollars

(thousands)

200520052004

Yen

(millions) U.S. Dollars

(thousands)

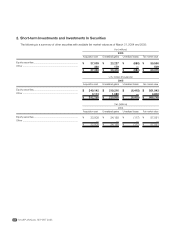

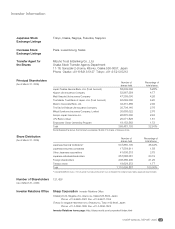

5. Short-term Borrowings and Long-term Debt

The weighted average interest rates of short-term bor-

rowings as of March 31, 2004 and 2005 were 1.3% and

1.1%, respectively. The Company and its consolidated

subsidiaries have had no difficulty in renewing such loans

when they have considered such renewal advisable.

Short-term borrowings including current portion of long-term debt as of March 31, 2004 and 2005 consisted of the following:

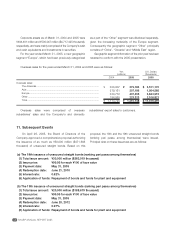

The following is a summary of the terms of conversion and redemption of the convertible bonds:

1.60% The convertible bonds, due 2004 ¥1,554.00 At 106% to 100% of principal after September 30, 1997,

decreasing 1% annually

Redemption at the option of the CompanyConversion price