Public Storage 2014 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2014 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

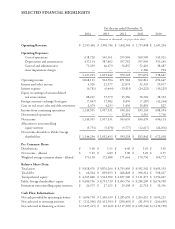

A breakdown of operating results follows:

Net Operating Income

(Amounts in millions)

2014 2013 2012

Same Store $ 120 $ 117 $ 121

Acquired/developed properties 9 8 8

Total $ 129 $ 125 $ 129

Public Storage’s share $ 63 $ 61 $ 63

Total assets (before depreciation reserves) $ 1,603 $ 1,709 $ 1,643

Since 2008, most of the operating cash flow at Shurgard Europe has been used to pay down debt. In 2014,

Shurgard Europe had reduced its leverage to a level enabling it to obtain very favorable financing, seven to twelve

year term at a blended rate of 3%, which repaid most of the loan from Public Storage and provided capital to

again grow.

Shurgard Europe’s portfolio had not increased much over the past six years. But in 2014 it resumed expansion,

acquiring five properties in Germany and beginning development of three properties in London.

In 2015 we anticipate Marc and Jean Kreusch, Shurgard Europe’s very capable CFO, will grow the company

in three ways: improving occupancies and revenues at the same store properties; developing and acquiring new

properties; and expanding its capital base, either with an IPO or a debt financing. I am very excited about our

prospects in Europe.

Commercial Properties

Our commercial properties, primarily our investment in PSB, performed well in 2014 as the improving economy

led to greater demand and better pricing for commercial space, which we expect will accelerate in 2015. Low

interest rates and numerous third-party purchasers posed challenges to PSB’s acquisition program. Joe Russell,

PSB’s CEO, and his team took advantage of these conditions and exited the Portland, Oregon and Phoenix,

Arizona markets. Given the environment, PSB was not able to deploy all of the sales proceeds and a portion of

the gain was distributed to shareholders. Our share was $40 million.

A breakdown of operating results follows:

Net Operating Income

(Amounts in millions)

2014 2013 2012

PSB’s Same Park operations $ 226 $ 222 $ 217

PSB’s acquired/developed properties 26 19 15

Public Storage’s owned commercial properties 10 9 9

Total $ 262 $ 250 $ 241

Public Storage’s share $ 117 $ 110 $ 105

Total assets (before depreciation reserves) $ 3,133 $ 3,284 $ 3,131

The improving economy should enhance PSB’s ability to drive rental rates and reduce capital (tenant improvements

and broker commissions) required to re-lease properties in 2015.